Introduction

Obtaining an Australian Financial Services Licence (AFSL) is essential for businesses aiming to provide financial services within Australia. Governed by the Corporations Act 2001 (Cth), the AFSL ensures that licensees meet stringent regulatory standards set by the Australian Securities & Investments Commission (ASIC), promoting efficiency, honesty, and fairness in the financial sector. This licensing framework not only protects consumers but also upholds the integrity of the Australian financial markets.

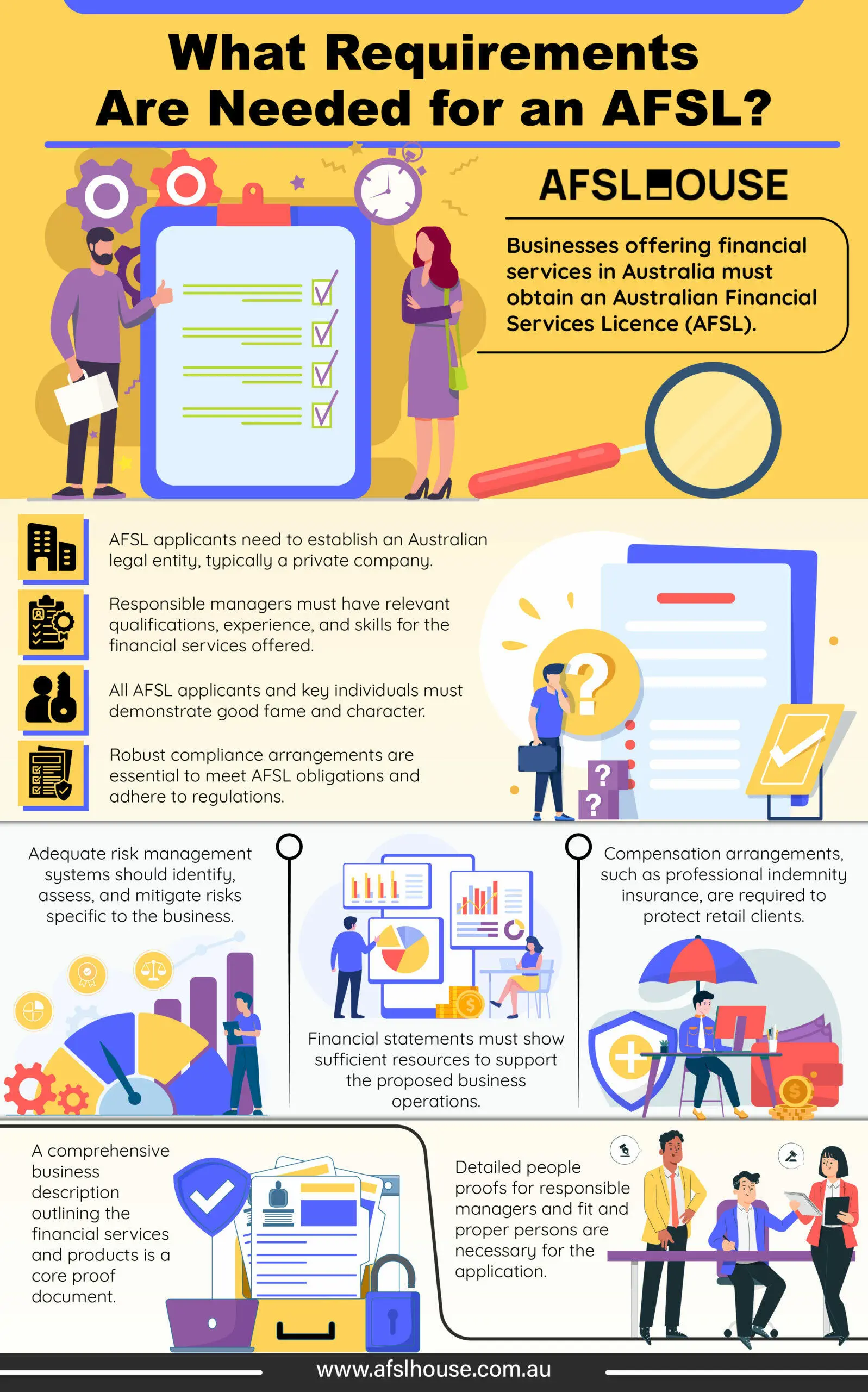

The AFSL application process encompasses a range of requirements, including the formation of an Australian entity, appointment of qualified responsible managers, and the establishment of robust compliance and risk management systems. Understanding and fulfilling these obligations is crucial for financial service providers to successfully acquire and maintain their licence, thereby enabling them to operate legally and effectively in the competitive Australian market.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Important: June 2025 AFS Licence Application Changes

This article has been updated to reflect the new AFSL application requirements introduced by ASIC, effective from 16 June 2025. Key requirements are now submitted as part of a single, online application on the ASIC Regulatory Portal, replacing the former system of separate ‘core proof’ documents.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Key Requirements for Applying for an AFSL

Formation of an Australian Entity

To apply for an AFSL, applicants must:

- Establish a legal entity within Australia, typically a private company (i.e. Pty Ltd)

- Register under the Corporations Act 2001 (Cth)

- Hold a valid Australian Business Number (ABN) or Australian Company Number (ACN)

- Have at least one Australia-resident director

These requirements ensure compliance with residency requirements set forth by ASIC.

Responsible Manager Qualifications

Another requirement for obtaining an AFSL is the appointment of responsible managers who must:

- Possess necessary qualifications, experience, and skills relevant to the financial services and products offered

- Demonstrate competency to perform their roles effectively

- Have relevant industry experience and appropriate educational backgrounds

- Show ability to manage and comply with AFSL holder obligations

- Have their qualifications and experience thoroughly documented and assessed

These Responsible Manager requirements ensure compliance with ASIC’s standards for competency and integrity.

Fit and Proper Person Test

All AFSL applicants, including responsible managers and key individuals, must satisfy the fit and proper person test as required by ASIC. This test, which replaced the narrower “good fame and character” assessment, ensures individuals involved in the entity have high ethical standards and integrity. It involves ASIC assessing:

- A person’s attributes of good character, diligence, honesty, and judgment

- Past criminal records and financial history

- Any involvement in regulatory breaches, which could trigger AFSL audits & investigations, or disqualification from managing a corporation

It’s crucial to note that providing false or misleading information in the application can lead to licence refusal or revocation, and if your AFSL application was rejected, what you can do is an important next step to understand

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Compliance and Risk Management Requirements

Compliance Arrangements

Establishing robust compliance arrangements to meet the AFSL obligations is essential when applying for an AFSL. Applicants must demonstrate in their online application that they have implemented comprehensive compliance measures to ensure adherence to the Corporations Act 2001 (Cth) and ASIC guidelines. These arrangements typically include:

- Internal Compliance Programs: Developing and maintaining policies and procedures that govern the provision of financial services, ensuring all operations align with legal and regulatory standards.

- Compliance Officers: Appointing dedicated personnel responsible for overseeing compliance activities, monitoring adherence to policies, and addressing any compliance issues promptly.

- Managing Conflicts of Interest: Implementing strategies to identify, prevent, and manage potential conflicts of interest that may arise in the course of providing financial services.

- Training and Education: Providing ongoing training to employees and representatives to ensure they understand their compliance responsibilities and stay updated on regulatory changes.

- Regular Audits and Reviews: Conducting periodic internal audits and compliance reviews to assess the effectiveness of compliance measures.

While applicants previously submitted a separate “B3 Compliance Arrangements” proof document, this information is now provided in response to specific questions within the integrated online application. Demonstrating these arrangements is vital for maintaining regulatory standards and building client trust.

Adequate Risk Management Systems

Additionally, Implementing adequate risk management systems to identify, assess, and mitigate risks associated with financial services businesses is crucial when applying for an AFSL. Tailored risk management systems should address the specific risks inherent to the nature, scale, and complexity of the business. Key components include:

Risk Identification: Systematically identifying potential risks that could impact the business operations, financial stability, and reputation. This includes market risks, operational risks, compliance risks, and strategic risks.

Risk Assessment and Analysis: Evaluating the identified risks in terms of their likelihood and potential impact, enabling the prioritisation of risk mitigation efforts.

Risk Mitigation Strategies: Developing and implementing actions to reduce the likelihood or impact of significant risks. This may involve diversifying service offerings, enhancing internal controls, or acquiring insurance coverage.

Monitoring and Reporting: Continuously monitoring risk factors and the effectiveness of mitigation strategies. Regular reporting mechanisms should be established to keep management informed about the risk landscape.

Crisis Management Planning: Preparing for unforeseen events by having contingency plans in place to ensure business continuity and minimise disruptions.

Integration with Compliance Programs: Ensuring that risk management processes are integrated with compliance arrangements to provide a holistic approach to governance.

By establishing robust risk management systems, businesses can demonstrate that they are ready to proactively address potential challenges, safeguard their operations, and maintain resilience in a dynamic financial landscape.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Financial Resources and Stability

Financial Statements and Resources

Applicants must demonstrate adequate financial resources to support their proposed business operations under the AFSL. While comprehensive financial statements are not required to be submitted with the initial online application (a change from the former “B5 Financial Statements and Financial Resources” core proof), applicants must be prepared to provide them upon request.

ASIC will ask for the following documents at the ‘requirements stage’ of the assessment, after making an in-principle decision to grant the licence:

- Balance Sheet: A snapshot of the company’s financial position, detailing assets, liabilities, and equity.

- Profit and Loss Statement: If the business is already trading, a statement showing revenues, expenses, and profits over a specific period.

- Cash Flow Statement: A projection or statement showing the inflows and outflows of cash within the business.

These documents must be current and signed by an authorised officer to ensure their validity and accuracy.

Compensation and Insurance Arrangements

To protect retail clients, applicants are required to have adequate compensation arrangements in place. This includes:

- Professional Indemnity (PI) Insurance: This insurance is mandatory for most AFSL holders providing services to retail clients and covers claims for damages arising from breaches of professional duty.

- External Dispute Resolution Membership: Membership with the Australian Financial Complaints Authority (AFCA) is required for licensees who serve retail clients.

Proof of PI insurance and AFCA membership is not required at the initial application lodgement. Instead, ASIC will request evidence of these arrangements at the ‘requirements stage’ before the final licence is granted, streamlining the upfront application process.

Note: The exact requirements for compensation arrangements may vary depending on the services provided. It is essential to consult the relevant sections of the AFS Licensing Kit and consider seeking professional advice to ensure compliance.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Core Proof Documents Required for AFSL Application

Business and Competence Information

A core part of the AFSL application is providing a comprehensive description of your business and demonstrating its organisational competence. This information is now submitted directly into the online application on the ASIC Regulatory Portal, replacing the need for former “core proof” documents like the A5 Business Description and B1 Organisational Competence.

This information must include:

- Overview of Financial Services and Products: A clear detail of each service and product the business will offer, including whether advice is personal or general and if clients are retail or wholesale.

- Organisational Structure: Details of the business structure, often supported by an uploaded organisational chart, highlighting the roles of responsible managers.

- Revenue Generation: An explanation of how the business will generate income, such as through fees or commissions.

- Operational Details: An outline of how services will be delivered to clients (e.g., online platforms, in-person consultations).

- Responsible Manager Competence: Detailed information on the experience and qualifications of each responsible manager, linking their skills to the specific authorisations sought.

People Proofs

People Proofs are the primary set of supporting documents that must be uploaded with your AFSL application to demonstrate the integrity and suitability of key individuals. These proofs are required for your nominated responsible managers and all other “fit and proper persons” who control the business.

The required documentation includes:

- Statement of Personal Information: A signed and witnessed statement for each person, detailing their background and experience.

- Criminal History Checks: National criminal history checks (police checks) that are no more than 12 months old.

- Bankruptcy Checks: Bankruptcy checks that are also no more than 12 months old.

- Qualification Certificates: Copies of relevant qualification certificates for each responsible manager to demonstrate their expertise.

By meticulously compiling these People Proofs, applicants demonstrate to ASIC that their business is managed by qualified, trustworthy individuals capable of upholding the high standards required for an Australian Financial Services Licence. Notably, business references for responsible managers, which were part of the previous requirements, are no longer required to be provided upfront with the application.

Conclusion

The AFSL is essential for businesses wishing to provide financial services in Australia. Applicants must meet several key requirements, including the establishment of an Australian entity, the appointment of qualified responsible managers, and the demonstration of good fame and character. Additionally, robust compliance and risk management systems, adequate financial resources, and thorough documentation are crucial for a successful application.

To navigate the complexities of the AFSL application process effectively, contact AFSL House’s AFSL application lawyers today. Our dedicated team has unparalleled expertise and is ready to assist you in ensuring compliance and preparing a strong application tailored to your business needs.

Frequently Asked Questions

An AFSL is a regulatory requirement for businesses wishing to provide financial services in Australia. It authorises the licensee and their representatives to offer financial product advice, deal in financial products, and operate various financial services, ensuring compliance with the Corporations Act 2001 (Cth) and ASIC regulations. Without an AFSL, businesses cannot legally conduct financial services, and it is important to understand the consequences of operating without an Australian Financial Services Licence.

How long the AFSL application process takes can vary significantly based on several factors, including the quality of the application and the complexity of the financial services proposed. Generally, the assessment process can take several weeks to a few months. Applicants can expedite the process by ensuring that all required information and supporting documents are complete and accurate when submitted.

Yes, a foreign business or person may need to apply for an Australian Financial Services Licence (AFSL), but they must meet specific requirements set by ASIC. This includes demonstrating that they hold relevant authorisations in their home country and comply with the ASIC Instrument 2020/198. The application process for foreign entities may differ slightly from that of domestic applicants.

If an AFSL application is rejected, ASIC will provide a letter explaining the reasons for the refusal. Applicants have the option to appeal the decision or address the issues raised and reapply. It is crucial to understand the specific reasons for rejection to improve the chances of success in a subsequent application.

Certain exemptions exist under the Corporations Act 2001 (Cth) where businesses may not require an AFSL. For example, individuals providing financial services that fall under specific thresholds or categories, such as limited financial services or advice to wholesale clients, may be exempt. However, it is essential to consult the relevant regulations to determine eligibility for any exemptions, such as the common exemptions from AFSL requirements for domestic companies.

AFS licensees must adhere to various ongoing obligations, including maintaining adequate compliance and risk management systems, ensuring responsible managers are competent and fit for their roles, and understanding what to notify ASIC after receiving an AFS licence. Licensees must also have a dispute resolution system in place if they provide services to retail clients.

To increase the likelihood of a successful AFSL application, applicants should ensure that they provide complete and accurate information, demonstrate organisational competence, and submit all required documents. Engaging with legal or compliance professionals can also help navigate the complexities of the application process.

The costs for applying for an AFSL include the application fee, which varies based on the type of license and the services offered. Additional costs may arise from preparing supporting documentation, legal fees, and compliance measures. It is advisable to consult ASIC’s fee schedule for specific amounts.

For more information about AFSL requirements, applicants can visit the ASIC website, which provides comprehensive resources, including the AFS Licensing Kit and relevant regulatory guides. These documents outline the necessary steps and requirements for applying for an AFSL.

Yes, seeking professional assistance for your AFSL application can be beneficial. Legal and compliance experts can provide guidance on the requirements, help prepare necessary documentation, and ensure that your application meets ASIC’s standards. This support can save time and resources, increasing the chances of a successful application.