Introduction

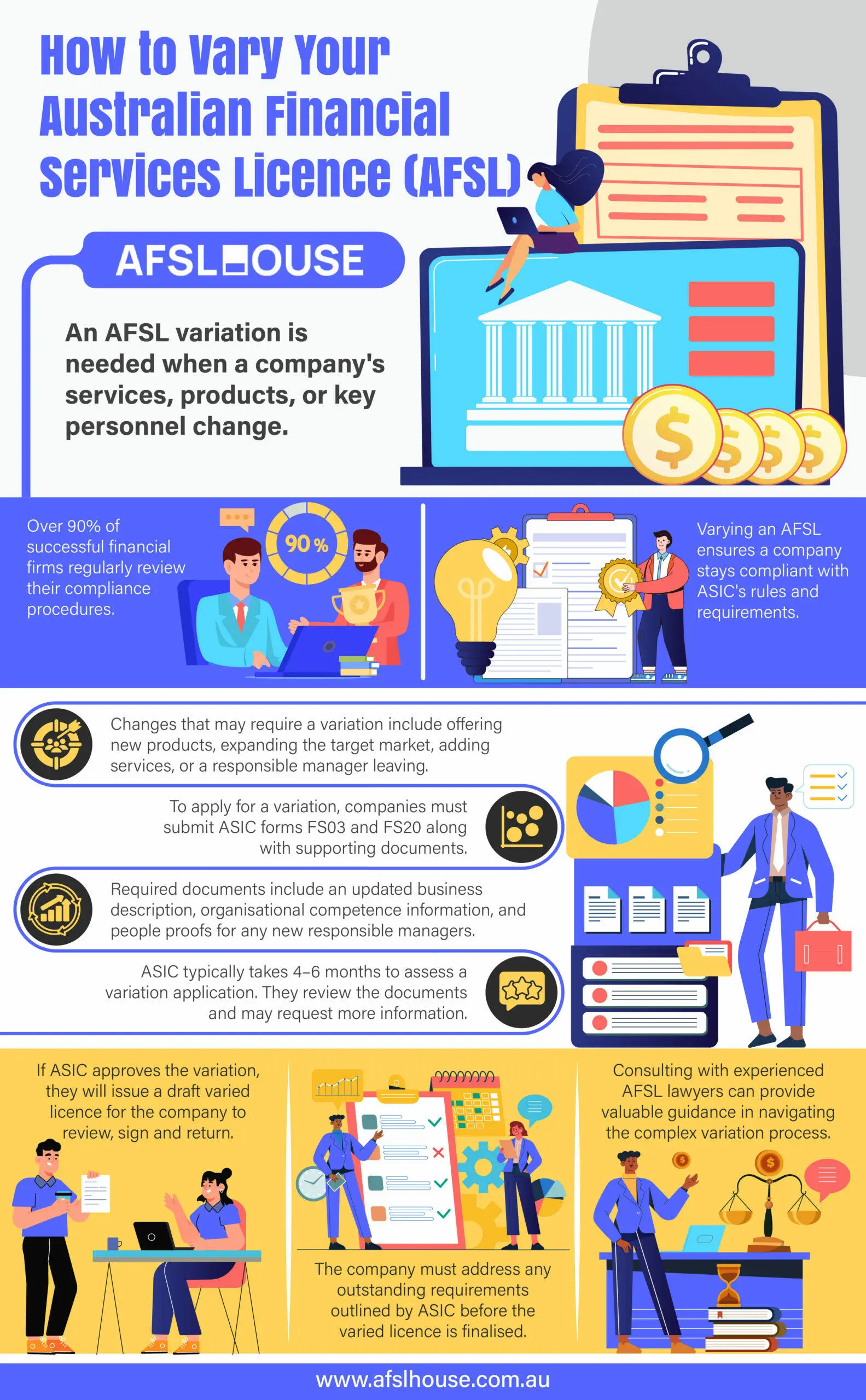

An Australian Financial Services Licence (AFSL) variation is needed when changes occur that impact the licence’s scope. These changes can range from offering new financial products or services to altering key personnel within the organisation. Understanding how to vary your licence through the ASIC Regulatory Portal is crucial for maintaining compliance.

This guide will cover the process of varying an AFSL, including when a variation is necessary, preparing the application, managing responsible manager changes, and navigating ASIC’s assessment process. We will explore the required information and documentation for the current online system, which has replaced the former process that used forms like the FS03 and FS20.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Understanding When to Vary Your AFSL

An AFSL must accurately reflect your current business activities and personnel arrangements. If your business undergoes significant changes, you may need to apply for a variation to your licence to remain compliant with ASIC’s requirements. Below are the key scenarios where a variation may be necessary, along with practical examples to illustrate when and why these changes are required.

1. Changes in Business Services or Products

A variation becomes necessary when you plan to expand or alter the financial services or products offered by your business. This ensures your licence authorisations align with your evolving business model and service offerings. Common scenarios include:

- Offering New Financial Products: For instance, if your current licence authorises you to advise on securities, but you wish to provide financial planning services or introduce a new financial product, such as a different type of managed investment scheme, a variation is required.

- Expanding Your Target Market: Shifting your target client base, such as understanding the difference between wholesale vs retail clients, may also necessitate a variation to ensure your licence covers the additional compliance obligations associated with retail clients.

- Adding New Services: Introducing additional financial services, such as claims handling or portfolio management, that are not covered by your existing licence requires a variation.

- Evolving Business Models: Even seemingly minor changes, like altering your service delivery methods or introducing new revenue streams, may require a licence variation to ensure compliance.

It’s essential to regularly review your AFSL to confirm that all current and planned services and products are adequately covered by your authorisations.

2. Key Person Condition Changes

Key personnel play a critical role in maintaining your licence compliance, and changes to these individuals often require a variation to your AFSL. Key persons are typically responsible for ensuring your business meets ASIC’s organisational competence requirements, and their presence is often a condition of your licence. Variations may be necessary in the following situations:

- Departure of a Key Person: For example, if a responsible manager leaves your organisation, you must notify ASIC and apply for a variation to either amend the key person condition or appoint a replacement who meets the required qualifications and experience.

- Changes in Business Structure: If your business structure changes in a way that affects the roles or responsibilities of key personnel, such as a merger or internal reorganisation, a variation may be required to reflect these changes.

- Shifting Responsibilities: When the responsibilities of a key person shift significantly, such as taking on a different role within the organisation, you may need to update your licence conditions to reflect the new arrangements.

- Modifying Organisational Competence: If your business needs to adjust its organisational competence arrangements, such as appointing additional responsible managers to support new services, a variation is necessary to maintain compliance.

Key persons are integral to your ability to provide authorised services competently. Ensuring their roles and qualifications align with your AFSL conditions is critical to maintaining proper oversight and meeting ASIC’s requirements.

By proactively addressing changes in your business services, products, or key personnel, and applying for a licence variation when necessary, you can ensure your business remains compliant and avoids potential regulatory issues.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Preparing Your AFSL Variation Application

When applying to vary your Australian Financial Services (AFS) Licence, it is essential to provide ASIC with the required documentation to demonstrate your business’s capacity to meet its regulatory obligations. The specific documents you need to submit depend on the nature of your variation. Below is a breakdown of the key requirements and considerations.

1. Required Information for a Variation

When applying to vary your AFSL, you must provide ASIC with critical information about your business. This information is now entered directly into the online variation application on the ASIC Regulatory Portal, replacing the former requirement to submit separate “core proof documents”.

The specific information required depends on the type of variation. For changes involving financial service or product authorisations, or key person conditions, you must provide:

- Business Description Information: A detailed overview of your current and proposed business operations, including organisational structure, financial services, client base, and revenue sources. This supersedes the former “A5 Business Description” proof.

- Organisational Competence Information: Details demonstrating your business’s ability to competently provide the new financial services. This includes information on your compliance frameworks, risk management systems, and the skills of your responsible managers, replacing the former “B1 Organisational Competence” proof.

If your variation only relates to other licence conditions (and not authorisations), you generally only need to provide the business description information. It’s important to ensure these details reflect all financial services under your AFSL, not just those affected by the variation.

2. Additional Supporting Documentation

In addition to the core proofs, ASIC may require additional supporting documentation depending on the specific authorisations you are seeking to vary. For example:

- If you are adding foreign exchange authorisations, you will need to prepare specific documents as outlined in ASIC Info Sheet 240.

- These additional proofs may relate to specific aspects of your business operations or the financial services you intend to provide.

Review ASIC’s guidance carefully, often with the help of AFSL lawyers, to ensure you provide all necessary supporting documents tailored to your variation request.

3. People Proofs for New Responsible Managers

If your variation involves adding new responsible managers, you must upload People Proofs for each individual. These documents allow ASIC to assess whether the new managers meet the “fit and proper” requirements. The following proofs are required for each new responsible manager:

- Statement of Personal Information

- National Criminal History Check (less than 12 months old)

- Bankruptcy Check (less than 12 months old)

- Copies of Qualification Certificates

This documentation must be uploaded as part of the online transaction used to notify ASIC of the change in responsible manager details. Notably, business references, which were a requirement under the previous system, no longer need to be provided with the initial application, though ASIC reserves the right to ask for them during assessment.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

The Application Process

Varying your AFSL involves several steps, including initiating an online transaction, providing detailed information, and uploading supporting documents through the ASIC Regulatory Portal. Below is a structured overview of the key stages to help you manage the process effectively.

1. Initiating a Variation Application Online

The first step in varying your AFSL is to apply online through the ASIC Regulatory Portal. This process replaces the previous system of completing and lodging a Form FS03. In the portal, you will initiate a specific “transaction” to vary your licence, where you must:

- Specify the type of variation you are seeking:

- Licence Authorisations (e.g., adding new financial services, products, or client types).

- Licence Conditions (e.g., amending a key person condition).

- Or both.

- Provide detailed information demonstrating you have the necessary systems and processes in place to support the new authorisations.

- Update information about your organisational competence and responsible managers, as prompted by the online form.

Completing the online application accurately is critical, as it forms the foundation of your variation request.

2. Lodging Supporting Documents

As you complete the online application, you must upload the required supporting documentation directly into the ASIC Regulatory Portal. This integrated system replaces the former method of submitting documents separately via the ASIC MOVEit portal. Key requirements include:

- People Proofs: For any new responsible managers, you must upload a complete set of their People Proofs.

- Business Information: Provide a detailed description of your current and future services, products, client types, and organisational structure within the application’s data fields. You may also upload supporting documents like an organisational chart.

- Alignment with ASIC Registers: Ensure all submitted information aligns with ASIC’s registers to avoid discrepancies that could delay the application process.

Providing accurate and complete documentation within the portal is essential to ensure your application progresses smoothly.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Managing Responsible Manager Changes

Notifying ASIC of Changes

Changes to your responsible managers are now managed through an online transaction on the ASIC Regulatory Portal. This streamlined process replaces the former requirement to lodge a Form FS20. Whether you are adding a new responsible manager as part of a broader variation or simply notifying ASIC of a change, you must complete the ‘Notify change of responsible manager details’ transaction in the portal.

Documentation Requirements

When adding new responsible managers, you must upload their People Proofs as part of the online notification. The essential documents include:

- Statement of Personal Information: A comprehensive document where the responsible manager accepts their nomination and provides their background details.

- Criminal History Check: A national criminal history check less than 12 months old.

- Bankruptcy Check: A current bankruptcy check dated within the last 12 months.

- Qualification Certificates: Copies of relevant educational and professional qualifications.

This documentation must be uploaded directly to the ASIC Regulatory Portal during the notification transaction. Notably, business references are no longer a required upfront document (a change from the previous system), and you no longer need to email proofs to a separate ASIC address.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

After Submission

Once you have submitted your AFSL variation application, ASIC begins its assessment process. This phase involves a thorough review of your documentation and may require additional input from you to ensure your application meets all regulatory requirements. Below is a structured overview of what to expect and how to respond effectively.

1. ASIC’s Assessment Process

ASIC typically takes four to six months to assess an AFSL variation application, although more complex applications may require additional time. The assessment process consists of two key stages:

- Completeness Check:

ASIC first conducts a review to ensure all required documentation is present and acceptable. To pass this initial review, your application must include:- Properly prepared core proof documents.

- Payment of the correct application fee.

- Detailed Assessment:

Once the application passes the completeness check, ASIC assigns it to a licensing analyst for a more detailed review. The level of scrutiny during this phase depends on your business model and the market context. During this stage, ASIC may request additional information or documentation, such as:- Updated Financial Statements: To demonstrate your current financial position.

- Cash Flow Projections: To show your ability to sustain the new financial services.

- Professional Indemnity Insurance Details: To confirm adequate coverage for the expanded scope of your licence.

- Additional Proof Documents: Specific to certain authorisations being sought.

ASIC’s assessment is thorough, sometimes involving AFSL audits and investigations, and aims to ensure that your business is fully equipped to meet its regulatory obligations under the varied licence.

2. Responding to ASIC Queries

If ASIC requests additional information during the assessment process, it is crucial to respond promptly and thoroughly to avoid delays or complications. To ensure a smooth process, you should:

- Address All Questions Comprehensively: Provide detailed and accurate responses to all of ASIC’s queries, ensuring you meet any specified timeframes.

- Provide Clear Explanations: For any complex aspects of your business model or operations, offer clear and concise explanations to help ASIC understand your application.

- Submit Complete and Tailored Documents: Ensure all additional documents are accurate, complete, and tailored to your specific circumstances.

- Maintain Open Communication: Keep communication lines open with ASIC throughout the assessment process to clarify any uncertainties or provide updates as needed.

Failure to respond adequately to ASIC’s requests may result in your application being assessed based on incomplete information, which could lead to delays or even refusal of your variation application, an outcome that raises the question of what to do if your AFSL application is rejected.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Finalising Your Variation

Once ASIC has reviewed and approved your AFSL variation application, there are final steps you must complete to formalise the process. These steps include reviewing the draft licence and addressing any outstanding requirements outlined by ASIC. Below is a structured overview of what to expect and how to proceed.

1. Draft Licence Review

When ASIC decides to grant your AFSL variation, they will issue a draft varied licence for your review. This document outlines the updated authorisations and conditions that will apply to your licence. To finalise this stage:

- Carefully Review the Draft Licence: Ensure that all authorisations and conditions accurately reflect the changes you requested in your variation application. Pay close attention to any specific wording or limitations that could impact your operations.

- Sign and Return the Consent Notice: The draft licence will be accompanied by a consent notice, which you must sign and return to ASIC to formally indicate your acceptance of the varied licence terms.

This step is critical to confirm that the varied licence aligns with your business needs and regulatory obligations.

2. Addressing Outstanding Requirements

Before ASIC issues your final varied licence, they will send you a requirements letter outlining any outstanding matters that need to be resolved. These requirements may include:

- Providing Updated Professional Indemnity Insurance Details: Ensure your insurance coverage aligns with the new authorisations granted under your varied licence.

- Confirming No Material Changes: Verify that there have been no material changes to the information provided in your variation application since its submission.

- Submitting Additional Documentation: Provide any additional documents requested by ASIC to support your expanded services, such as updated compliance policies or operational procedures.

- Demonstrating Financial Adequacy: Show that your business meets the financial requirement obligations to support the new authorisations and expanded scope of services.

It is essential to address these requirements promptly. If matters remain unresolved for an extended period, ASIC may withdraw their offer of a varied licence.

3. Communicating with ASIC

If you encounter difficulties meeting any of the outstanding requirements, it is important to contact ASIC immediately to discuss your situation. Open communication can help clarify expectations and potentially negotiate extensions or alternative solutions to meet their requirements.

Conclusion

Varying an AFSL requires careful preparation and attention to detail throughout the application process. Understanding the requirements, preparing comprehensive documentation, and maintaining open communication with ASIC are essential elements for a successful variation. A well-planned approach that addresses all regulatory requirements while anticipating potential challenges can help streamline the process.

For guidance and support with your licensing needs, connect with our AFSL application lawyers at AFSL House. We offer expertise in preparing variation applications, managing responsible manager changes, and ensuring compliance with ASIC’s requirements, helping you adapt your license to meet your evolving business needs while maintaining AFSL compliance.

Frequently Asked Questions

The AFSL variation process typically takes four to six months. More complex variations may require additional time for assessment.

The fees for varying an AFSL depend on the nature of the variation. Minor administrative changes, such as updating responsible manager details through the ASIC Regulatory Portal, may have a small fee or no fee. However, more substantial variations involving new authorisations or services incur fees comparable to a new AFSL application.

Yes, you can withdraw your AFSL variation application at any stage. If withdrawn during the completeness check, the fee may be held for a future application or refunded upon request. However, if withdrawn after lodgement, the fee is generally non-refundable.

If ASIC rejects your variation application, your existing licence remains valid. ASIC will provide reasons for the rejection, and you may have options to withdraw, provide further submissions, or apply to the Administrative Appeals Tribunal for review, a process where experienced AFSL lawyers can provide crucial representation.

No, for minor administrative changes like a business address or name update, you simply need to complete the relevant online notification transaction on the ASIC Regulatory Portal. This replaces the former Form FS20 and does not require you to submit a full variation application or new proof documents.

To add a responsible manager, you must first complete the ‘Notify change of responsible manager details’ transaction on the ASIC Regulatory Portal, which includes uploading their People Proofs. Once that is done, you can proceed with your main variation application, which now allows you to select the newly added manager. This integrated online process replaces the former system of lodging separate FS20 and FS03 forms.

Your existing AFSL remains in effect while the variation is being processed. You can continue operating under the current authorisations and conditions until the varied licence is granted.

No, you cannot offer new financial services until your AFSL variation is approved and the varied licence is granted by ASIC. Providing services outside your current authorisations is a breach of your licence conditions.

Contact ASIC immediately if you need to amend your variation application after submission. They can advise on the appropriate process for making changes and whether it will impact the assessment timeline.

Disclaimer: All information provided in this article is strictly general in nature and is not intended to be, nor should it be relied upon as, legal advice.