Introduction to AFS Licensing and Core Proofs

Obtaining an Australian Financial Services Licence (AFSL) is a crucial step for businesses intending to provide financial services or products in Australia. The Australian Securities and Investments Commission (ASIC) is responsible for assessing AFSL applications to ensure that only competent and ‘fit and proper’ entities are authorised to provide these services. Prior to the application process changes on 16 June 2025, applicants were required to submit supporting core proof documents to ASIC.

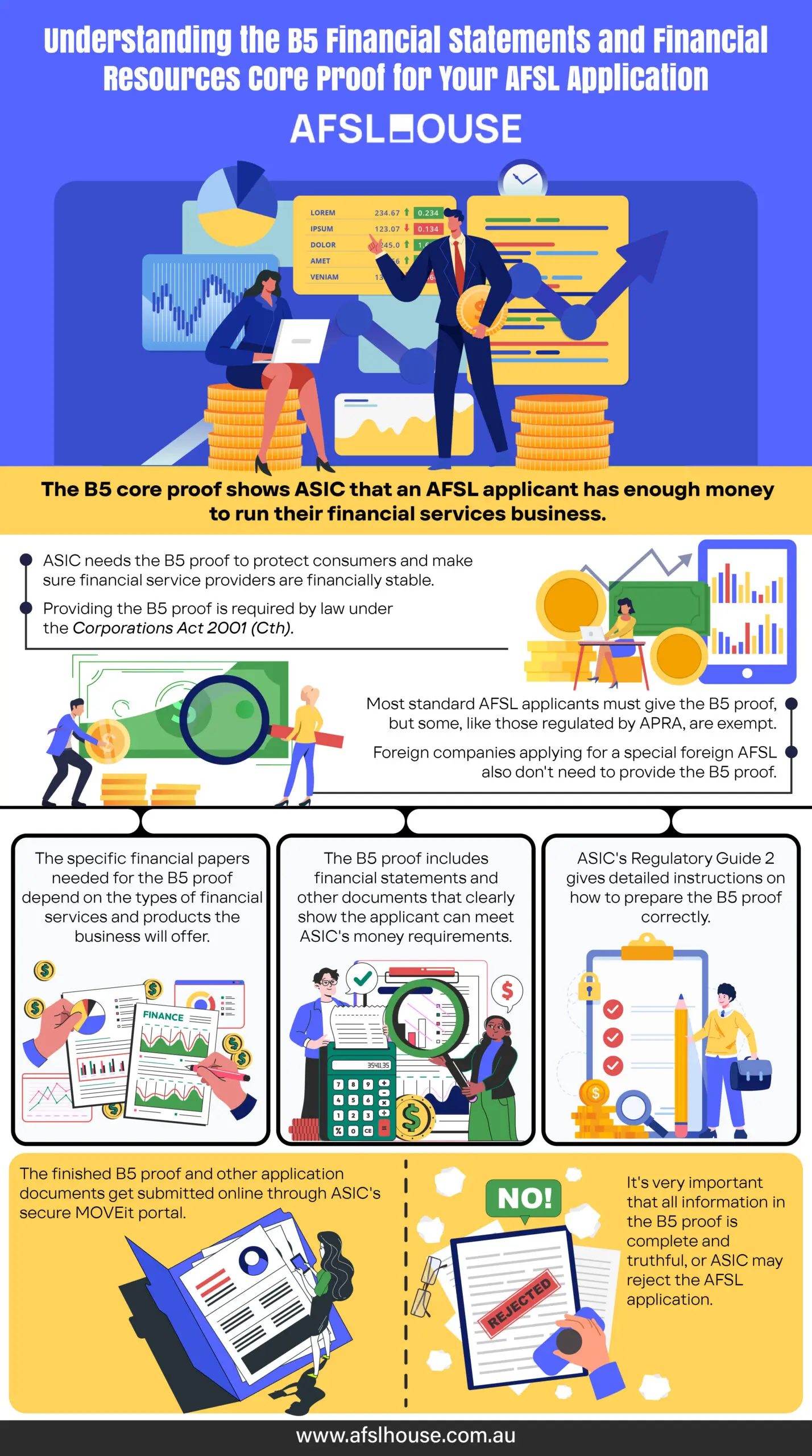

Among these former core proofs, the B5 Financial Statements and Financial Resources was an essential document. This guide explains what the B5 Financial Statements and Financial Resources core proof was and how it was completed when applying for an AFSL under the previous system.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Important Note on the June 2025 AFSL Changes

This article has been updated to clarify that the B5 Financial Statements and Financial Resources core proof is no longer required as part of the initial AFSL application, following ASIC’s process changes on 16 June 2025. The information is retained for historical context, as ASIC now requests this financial information later in the assessment process at the ‘requirements stage’.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Defining the B5 Financial Statements and Financial Resources Core Proof

Purpose of the B5 Core Proof

Prior to the application changes on 16 June 2025, the B5 Financial Statements and Financial Resources core proof was a crucial component of an AFSL application because:

- Ensuring Adequate Financial Resources: ASIC required this core proof to confirm that applicants possess sufficient financial resources to conduct their proposed financial services business.

- Protecting Consumers: This requirement helped safeguard consumers by ensuring that financial service providers were financially stable.

- Maintaining Industry Integrity: By verifying financial resources, ASIC maintained the integrity of the financial services industry.

Regulatory Basis for the B5 Proof

Providing the B5 core proof was not merely an administrative step, but a regulatory requirement mandated by the Corporations Act 2001 (Cth). While a key consideration during the AFSL application process remains whether the applicant has sufficient financial resources as stipulated under section 912A(1)(d) of the Corporations Act 2001 (Cth), the B5 proof was the specific document used to demonstrate this at the application stage. As of 16 June 2025, ASIC requests this information later in the process at the ‘requirements stage’ rather than as an upfront ‘core proof’ document.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Who Needs to Provide the B5 Core Proof?

General Requirement for AFSL Applicants

Under the application system in place prior to 16 June 2025, generally all standard applicants for an AFSL were required to provide the B5 Financial Statements and Financial Resources core proof as part of their application. This requirement applied to demonstrate that the applicant possessed sufficient financial resources to operate their proposed financial services business. This was a fundamental step in the former AFSL application process, aimed at ensuring that Australian financial services (AFS) licensees are financially stable and capable of meeting their obligations under the Corporations Act 2001 (Cth).

Exemptions from Providing B5 Proof

Specific exemptions from the former requirement to provide the B5 core proof existed. Applicants regulated by the Australian Prudential Regulation Authority (APRA) were exempt from needing to provide this specific core proof. This exemption recognises that entities regulated by APRA are already subject to stringent financial oversight and are deemed to have met equivalent financial resource standards.

Foreign AFSL Applicants (FFSPs) and B5 Proof

Foreign Financial Services Providers (FFSPs) applying for a foreign AFSL also received an exemption from submitting the B5 Financial Statements and Financial Resources core proof. This exemption is part of a streamlined application process for FFSPs, a key principle behind the foreign AFS licence, acknowledging that these entities are already authorised and regulated in equivalent overseas regulatory regimes. Therefore, the requirement to provide separate B5 proof was waived for FFSPs seeking a foreign AFSL to provide financial services in Australia.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Key Documents in the B5 Financial Statements and Financial Resources Core Proof

Identifying Applicable Financial Requirements

Previously, as part of preparing the B5 Financial Statements and Financial Resources core proof, applicants for an AFSL had to first determine the specific financial requirements that applied to their business. This crucial initial step depended on:

- Nature of Financial Services and Products: The specific services and products the applicant intended to provide under their AFSL influenced the applicable financial requirements.

- Accurate Identification of Requirements: Precisely identifying these requirements ensured that the B5 core proof effectively demonstrated the applicant’s financial capacity to operate their proposed financial services business.

Financial Statements and Supporting Documentation

Under the former process, the B5 Financial Statements and Financial Resources core proof required the provision of:

- Financial Statements: These documents had to clearly demonstrate the applicant’s capacity to meet the identified financial requirements.

- Supporting Documentation: Additional relevant documents were required to provide ASIC with a comprehensive understanding of the applicant’s financial position and ability to sustain a viable financial services business.

This evidence allowed ASIC to assess whether the applicant possessed adequate financial resources. While this assessment is still a key part of the process, following the changes on 16 June 2025, ASIC now requests relevant financial statements at the ‘requirements stage’ if they are looking to approve an application, rather than as an upfront core proof.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Completing and Lodging the B5 Financial Statements and Financial Resources Core Proof

Referencing Regulatory Guide 2

Previously, to ensure thorough preparation of the B5 Financial Statements and Financial Resources core proof, applicants consulted Section E of the ASIC Regulatory Guide 2. This guide provided detailed instructions and essential information necessary for compiling the core proof document. Carefully reviewing this section was crucial to:

- Understand Requirements: Gain a comprehensive understanding of ASIC’s former expectations for the B5 core proof;

- Ensure Compliance: Address and document all aspects of the B5 core proof accurately as per ASIC’s guidelines; and

- Enhance Accuracy: Avoid common pitfalls by following the structured instructions provided in Regulatory Guide 2.

By adhering to the guidance in Regulatory Guide 2, applicants could effectively prepare a compliant and robust B5 core proof for their AFSL application.

Submitting B5 Proof via ASIC MOVEit Portal

Prior to 16 June 2025, the submission process for the B5 Financial Statements and Financial Resources core proof, along with other required application documents, was completed electronically through the ASIC MOVEit portal. This system is now redundant for AFSL applications. The former process required that applicants:

- Follow Submission Instructions:

- After submitting the online application form, applicants would receive detailed instructions on how to upload their documents via the ASIC MOVEit portal.

- It was essential to adhere to these instructions meticulously to prevent any delays or issues with the application.

- Ensure Document Security:

- The ASIC MOVEit portal provided a secure platform for transmitting sensitive financial documents.

- Verify Successful Submission:

- After uploading, applicants would need to confirm that all documents, including the B5 proof, were successfully lodged.

This process is now obsolete. As of 16 June 2025, all documents are uploaded directly through the ASIC Regulatory Portal as part of the online application transaction, and there is no longer a separate submission step through the MOVEit portal.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Importance of Accuracy and Completeness of B5 Proof

Completeness Check and Application Rejection

AASIC conducts a completeness check on all AFSL applications to ensure that each application is fully completed and contains all necessary information. Under the former system, this check specifically included the B5 Financial Statements and Financial Resources core proof. If that B5 core proof was incomplete or inadequate, the following consequences could occur:

- Rejection of Application: ASIC could reject the AFSL application for lodgement if the B5 core proof did not meet the required standards.

- Reapplication Requirement: Applicants with incomplete applications were required to re-apply for an AFSL, a situation where they might wonder what to do if their AFSL application was rejected.

Ensuring the completeness and adequacy of the B5 core proof was therefore essential to avoid these setbacks in the AFSL application process.

False or Misleading Information

Providing false or misleading information in your AFSL application is a serious offence under section 1308 of the Corporations Act 2001 (Cth). This has always been the case and remains a critical point of compliance. The implications of submitting inaccurate information, which previously would have included details in the B5 core proof, include:

- Licence Denial: ASIC must not grant an AFSL if an applicant has provided false or misleading information or made a material omission in their application.

- Licence Revocation: If false or misleading information is discovered after a licence has been granted, ASIC has the authority to revoke the AFSL, often following AFSL audits & investigations.

- Legal Consequences: Submitting fraudulent information can lead to legal actions and penalties under the Corporations Act 2001 (Cth).

Therefore, it is critical to ensure that all information provided to ASIC is accurate and truthful to maintain AFSL compliance and uphold the integrity of the AFSL application.

Conclusion

The B5 Financial Statements and Financial Resources core proof was a critical document in the AFSL application process prior to the system changes on 16 June 2025. This core proof was essential for demonstrating to ASIC that an applicant possessed the necessary financial resources to operate their proposed financial services business and meet their AFSL compliance obligations as an AFS licensee under the Corporations Act 2001 (Cth). While providing this specific upfront proof is no longer required, the fundamental obligation to have adequate financial resources remains.

Navigating the complexities of applying for an AFSL and its evolving regulatory requirements can be challenging. To ensure your application is robust and meets all of ASIC’s current expectations under the new, streamlined process, contact AFSL House’s expert AFSL application lawyers today for a free initial consultation. With a 100% success rate, our unparalleled expertise can guide you through each step, ensuring a smooth and efficient application process and helping you secure your Australian Financial Services Licence.

Frequently Asked Questions

The purpose of the B5 Financial Statements and Financial Resources core proof was to demonstrate to ASIC that an AFSL applicant had adequate financial resources to carry out their proposed financial services business. While this specific document is no longer required upfront, applicants must still be able to demonstrate they meet financial requirements at a later stage of the application process.

Previously, detailed instructions on how to prepare the B5 core proof could be found in Section E of ASIC’s Regulatory Guide 2. As this document is no longer part of the initial application, applicants should now refer to ASIC’s guidance on the new application process via the ASIC Regulatory Portal.

Foreign Financial Services Providers applying for a foreign AFSL were not required to provide the B5 core proof under the old system. This exemption is part of the streamlined application process that continues for Foreign Financial Services Providers in Australia.

Under the former application system, if an applicant did not provide the B5 core proof, their AFSL application could be rejected for incompleteness. This is no longer a relevant concern, as the B5 proof has been removed from the initial submission requirements as of 16 June 2025.

There was no specific form for the B5 Financial Statements and Financial Resources core proof. It was a document that applicants had to prepare and submit as part of their AFSL application, as detailed in ASIC Regulatory Guide 2.

Yes, your AFSL application can still be refused if ASIC deems your financial resources to be insufficient. Although the B5 proof is no longer submitted with the application, ASIC now requests and assesses relevant financial statements at the ‘requirements stage’ before deciding to approve your licence.

Under the new process effective 16 June 2025, ASIC will ask you to provide relevant financial statements at the ‘requirements stage’ if it is looking to approve your application. The need for these statements to be audited will depend on the specifics of your business and the authorisations you seek.

After obtaining an AFSL, licensees have ongoing obligations to ASIC, including lodging annual accounts and audit reports, so it is important to understand what to notify ASIC after receiving your AFS licence. This requires a continued demonstration of sufficient financial resources as part of your ongoing obligations as an AFS licensee.

Previously, you would have submitted the B5 core proof electronically via the ASIC MOVEit portal. As of 16 June 2025, this portal is no longer used for these applications. All documents are now uploaded directly through the ASIC Regulatory Portal as you complete the online application transaction.