Introduction

Obtaining an Australian Financial Services Licence (AFSL) is essential for financial advisors, fintech companies, and other financial service businesses seeking to operate legally within Australia. This licence, mandated by the Corporations Act 2001 (Cth), ensures that licensees possess the necessary knowledge and skills to provide financial services efficiently, honestly, and fairly, thereby protecting consumers and maintaining market integrity.

The AFSL application process requires lodging a detailed online application through the ASIC Regulatory Portal and providing essential supporting documentation. This information and the required documents demonstrate compliance with Australian Financial Services regulations and are crucial for a successful licence application. This guide aims to detail the essential documents needed for applying for an AFSL, assisting businesses in navigating the complex compliance landscape effectively.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Important: June 2025 AFS Licence Application Changes

This article has been updated to reflect the new AFSL application process introduced by ASIC, effective from 16 June 2025. The guide below outlines the current requirements for lodging an application and the essential documents you need to provide through the ASIC Regulatory Portal.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Financial Statements and Financial Resources

Preparing Financial Statements

Accurate financial statements are essential for demonstrating your organisation’s financial health and its ability to comply with ongoing AFSL obligations. While you are not required to provide financial statements with your initial application, you must be prepared to submit them to ASIC during the assessment process. These statements must adhere to relevant Australian accounting standards and should include:

- Balance Sheet: Details your organisation’s assets, liabilities, and equity, providing a snapshot of your financial position at a specific point in time.

- Income Statement: Shows your organisation’s revenues and expenses over a defined period, illustrating profitability.

- Cash Flow Statement: Tracks the flow of cash in and out of your business, highlighting your ability to generate cash to meet obligations.

ASIC will request these financial statements at the ‘requirements stage’ of the assessment. This occurs after ASIC has made an ‘in-principle’ decision to grant the licence, and you must provide this evidence to prove you meet the necessary financial requirements before the licence is formally issued.

To ensure your financial statements meet ASIC’s requirements when requested:

- Adhere to Accounting Standards: Follow applicable Australian accounting standards to ensure consistency and accuracy.

- Regular Audits: Conduct regular internal and external audits to verify the integrity of your financial data.

- Detailed Reporting: Include all necessary financial activities without omission, providing a clear and comprehensive view of your financial performance.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

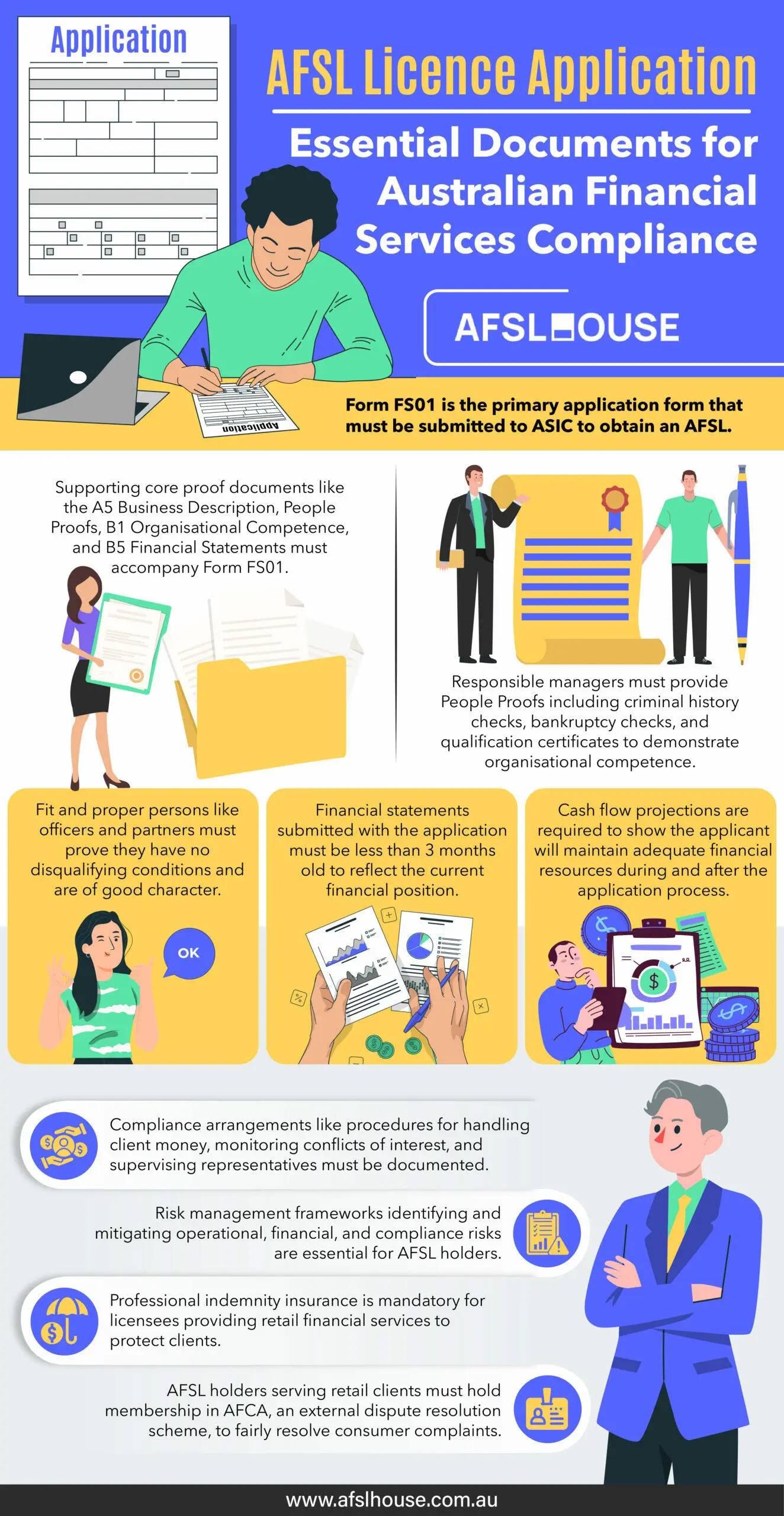

Essential Documents for AFSL Licence Application

The New AFSL Application Process

As of 16 June 2025, the AFSL application process was significantly streamlined by ASIC. The previous method, which required applicants to complete a Form FS01 and submit a series of separate “core proof documents” via an eLicensing system, has been replaced.

The current application is now a single, integrated online “transaction” completed through the ASIC Regulatory Portal. Much of the detailed information that was previously provided in separate documents is now captured directly within the online application as structured data.

Understanding the Former “Core Proof Documents”

While no longer required as separate submissions, understanding the purpose of the former “core proof documents” is essential, as the information they contained is still required within the new online application. These documents demonstrated an applicant’s compliance with ASIC’s general obligations, financial requirements, and competence under the Corporations Act 2001 (Cth).

The primary core proofs under the old system included:

- A5 Business Description: The A5 Business Description explained how the business would operate as an AFSL holder, detailing the scale and complexity of its financial services and products. This information is now provided in response to specific questions within the online application.

- B1 Organisational Competence: The B1 Organisational competence focused on the nominated responsible managers, detailing their deemed “organisational competence” such as collective industry experience, qualifications, and how they would manage compliance and risk. This information is also now captured within the online application.

- B5 Financial Statements and Financial Resources: Applicants used the B5 Financial Statements and Financial Resources proof to demonstrate financial stability with balance sheets, profit statements, and cash flow projections. Under the new process, ASIC requests this information at the ‘requirements stage’—that is, after an in-principle decision to approve the licence has been made—rather than upfront with the initial application.

- People Proofs: These proofs are used to verify the experience, good standing, and fitness and propriety of each responsible manager and other key individuals. They generally include national criminal history checks, bankruptcy checks, qualification certificates, and business references. People Proofs are the primary supporting documents that are still required to be uploaded with your online application.

Under the previous system, these documents had to be prepared with precision and submitted alongside Form FS01. Now, applicants provide the substantive information within the online form and upload the required People Proofs directly to the ASIC Regulatory Portal.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

People Proofs: Responsible Managers and Fit and Proper Persons

Responsible Managers

Having responsible managers is essential for demonstrating the organisational competence needed to obtain an AFSL. Each responsible manager must provide a specific set of documents, known as ‘People Proofs’, as required under the Corporations Act 2001 (Cth) and ASIC Regulatory Guides. These proofs are used to demonstrate their capacity to fulfil their role as part of the overall compliance arrangements.

Key documentation required as People Proofs for responsible managers includes:

- A duly completed and signed Statement of Personal Information, verifying identity and role scope

- A national criminal history check (less than 12 months old) to confirm no serious convictions

- A bankruptcy check (less than 12 months old) to ensure financial stability

- Copies of qualification certificates that align with the financial products the licensee seeks to authorise

These People Proofs must be uploaded during the online application process via the ASIC Regulatory Portal. They help confirm that each responsible manager has the capacity to supervise the financial services and meet the Australian Financial Services (AFS) licensee’s general obligations.

Fit and Proper Persons

Any individual controlling or influencing the business must prove they meet “fit and proper” criteria. This ensures the licensee is competent, honest, and trustworthy under relevant AFSL conditions and ASIC’s requirements. People considered fit and proper include officers of a body corporate, partners or trustees in a multiple-trustee structure, or controllers of the entity seeking authorisation.

As part of the licence application, People Proofs must be provided for these individuals. The required documents typically include:

- A duly completed and signed Statement of Personal Information covering background, roles, and business interests

- A national criminal history check (less than 12 months old) verifying no disqualifying offences

- A bankruptcy check (less than 12 months old) establishing financial soundness

By submitting these People Proofs, each applicant shows they meet the standards necessary to obtain an AFSL. These checks also help ASIC determine if any individual poses a risk to clients, financial products, or the broader financial services laws.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Financial Statements and Financial Resources

Preparing Financial Statements

Accurate financial statements demonstrate an applicant’s capacity to meet AFSL compliance obligations under the Corporations Act 2001 (Cth). While not required to be submitted with the initial application, applicants must be prepared to provide financial statements and other evidence of their financial resources to ASIC during the assessment process.

This request typically occurs at the ‘requirements stage’, after ASIC has made an in-principle decision to approve the application and sends the applicant a draft licence. The final licence will not be granted until ASIC is satisfied that the applicant has adequate financial resources. The statements must be current, tailored to the specific financial products and services planned, and include:

- Balance Sheet

- Profit and Loss Statement

- Supporting notes that reflect the scale and complexity of the proposed business.

A responsible manager should collaborate with the applicant’s finance team or external professionals to ensure these documents are finalised and ready for submission when requested by ASIC.

Cash Flow Projections

Cash flow projections are required to demonstrate how an applicant will maintain adequate financial resources to operate the business. The specific projections you will need to prepare for ASIC’s assessment depend on which of the 5 options you choose to use to meet the cash needs requirement:

- Reasonable Estimate Projection Plus Cash Buffer

- Contingency-Based Projection

- Financial Commitment by an Australian ADI or Comparable Foreign Institution

- Expectation of Support from an Australian ADI or Comparable Foreign Institution

- Parent Entity Prepares Cash Flow Projections on a Consolidated Basis

It is important to provide realistic assumptions and allocate funds for any unexpected costs. Whether the applicant intends to offer custodial services, traditional trustee services, or other financial products, detailed projections help ASIC assess financial adequacy and ensure the licensee is competent to provide the services under its proposed licence conditions.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Compliance Arrangements and Risk Management

Compliance Arrangements

Effective arrangements ensure an AFSL licensee consistently meets its obligations under Australian financial services laws. As part of the online licence application, businesses must provide detailed information demonstrating:

- How they plan to handle client money

- Methods for monitoring conflicts of interest

- Systems for supervising authorised representatives who provide financial products

Applicants must have documented policies and procedures that cover these obligations, including:

- Written procedures for task oversight

- Processes for breach identification and reporting

- Methods for addressing systemic issues

Within the online application, applicants must detail their capacity to maintain ongoing compliance, outlining their routine checks, training provisions, protocols for managing regulatory changes, and methods for senior management to monitor the compliance systems across all business activities. Ensuring these processes are robust and tailored to the scale and complexity of the enterprise is vital for demonstrating licensee competence and preparedness.

Risk Management Systems

Detailed risk management frameworks, often developed with guidance from experienced AFSL lawyers, are required to show that an AFS licensee has sufficient strategies to identify, assess, and mitigate potential threats in its financial services business. In the application, applicants must be able to describe their systems for managing:

- All relevant operational risks

- Financial risks

- Compliance risks associated with their services and products

- Methods for monitoring, escalating, and addressing risks that breach licence conditions

As part of the AFSL application, applicants will be asked about their internal risk assessment policies, which should be consistent with a formalised risk register and include:

- Information on reporting lines

- Frequency of risk reviews

- Responsibilities for managing day-to-day issues

Such systems verify that the licensee is maintaining adequate oversight and is positioned to proactively handle emerging challenges within its Australian financial services operations.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Compensation and Insurance Arrangements

Professional Indemnity Insurance

AFS licensees providing retail financial products or services must maintain adequate professional indemnity (PI) insurance to protect clients and meet obligations under the Corporations Act 2001 (Cth).

While applicants are not required to have a policy in place when they first lodge their application, ASIC will only grant a licence once it is satisfied the insurance coverage is adequate. As part of the assessment, after an ‘in-principle’ decision is made, ASIC will issue a ‘requirements letter’ requesting evidence of the PI insurance. This typically includes:

- A certificate of currency

- Policy schedules and coverage limits

- A completed PI insurance questionnaire from ASIC

Some applicants may be exempt from this requirement if regulated by APRA or if they have alternative arrangements approved by ASIC. However, most licensees must show that their professional indemnity policy aligns with the scale and complexity of their financial services business.

Membership to Dispute Resolution Scheme

Every AFSL holder offering services to retail clients must hold a membership in an ASIC-approved external dispute resolution scheme. The primary scheme is the Australian Financial Complaints Authority (AFCA), which manages complaints and addresses issues arising under the AFSL.

While applicants do not need to be a member of AFCA at the time of lodging their application, a licence will not be granted until membership is secured. Proof of AFCA membership is another key item that ASIC will request at the ‘requirements stage’ of the assessment process.

In addition to external dispute resolution, licensees must have their own internal dispute resolution procedures in place to:

- Manage less complex complaints

- Handle conflicts of interest before AFCA escalation

- Comply with Corporations Act 2001 (Cth) requirements

- Align with ASIC’s regulatory guides

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Common Mistakes to Avoid

Incomplete Documentation

Failing to provide all required information in the online application or failing to upload all necessary People Proofs can halt the AFSL application process under the Corporations Act 2001 (Cth). When lodging the application via the ASIC Regulatory Portal, each applicant must provide complete answers to all questions and upload a full set of People Proofs for each relevant person.

Applicants must confirm that every responsible manager’s People Proofs are included, such as a national criminal history check and a bankruptcy check, both less than 12 months old. Submitting an incomplete application or missing documents can lead to a rejection for lodgement, and it is important to know what to do if your AFSL application is rejected.

Outdated or Inaccurate Proofs

Incorrect or expired documents can jeopardise AFSL compliance. It is crucial for each applicant to provide recent national criminal history checks and bankruptcy checks, along with current and accurate qualification certificates for their responsible managers.

The information provided in the online application about a responsible manager’s competence must accurately reflect the authorisations specified in the application, which may include superannuation or custodial financial products. Furthermore, if financial statements and projections are requested by ASIC during the assessment, they must be current and accurately matched to the scale and complexity of the proposed business. Providing outdated or inaccurate information ensures a smoother lodgement and reduces the risk of rejection or significant delays.

Conclusion

Obtaining an AFSL requires careful preparation of an online application that demonstrates organisational competence, financial stability, and proper oversight of responsible managers. Each applicant must provide detailed information within the ASIC Regulatory Portal and submit essential People Proofs to satisfy ASIC’s regulatory guide obligations under the Corporations Act 2001 (Cth). This shows they can meet ongoing compliance obligations for all financial products and services listed in their licence application.

If you require assistance navigating this complex process, contact the expert AFSL application lawyers at AFSL House to ensure your submission is comprehensive and meets all of ASIC’s requirements.

Frequently Asked Questions (FAQ)

The AFSL application is an online transaction that must be completed via the ASIC Regulatory Portal. It collects key business details, financial information, and requires the upload of supporting documents (primarily People Proofs) to demonstrate compliance with the Corporations Act 2001 (Cth) and relevant regulatory guides.

A responsible manager oversees important day-to-day decisions related to the financial products and services listed in an AFSL application. They must submit People Proofs—such as national criminal history checks, bankruptcy checks, and qualification certificates—to confirm their organisational competence and show that the prospective licensee meets key requirements under ASIC’s regulatory guides.

Financial statements are not submitted with the initial application. ASIC will request them during the assessment at the ‘requirements stage’ if they make an in-principle decision to grant the licence. At that point, the financial statements you provide should be current to reflect your business’s financial position.

A fit and proper person must not be disqualified by law and must show good character, proper conduct, and no unresolved conflicts of interest. Individuals managing or controlling an AFS licensee must provide People Proofs, including up-to-date national criminal history and bankruptcy checks, to satisfy ASIC’s regulatory obligations.

While you can outsource your AFSL compliance tasks, such as compiling People Proofs, the AFSL applicant remains directly responsible for the accuracy of all information submitted in the online application. Any outsourced activity must still result in an application that complies with all authorisation requirements and general obligations.

AFCA (Australian Financial Complaints Authority) is an external dispute resolution service mandatory for AFSL holders offering services to retail clients. Membership is proven through core proof documents, ensuring that retail consumers have a fair resolution mechanism for complaints related to financial products or conflicts of interest under AFSL licence conditions.

Professional indemnity insurance is generally required for providing financial services to retail clients. You do not need to have a policy when you first apply, but you must provide proof of adequate coverage to ASIC during the ‘requirements stage’ before a licence will be granted.

Missing a required People Proof or failing to provide complete information in your online application can lead ASIC to reject it for lodgement. A fresh application and additional fees would then be required, extending the overall licence application process and delaying authorisations.

Responsible managers must provide a complete set of People Proofs, including their relevant qualification certificates. You must also detail their skills and experience within the online application to demonstrate that their competence aligns with each financial product or authorisation the business seeks to offer, in line with ASIC’s guidance in RG 105.