Introduction

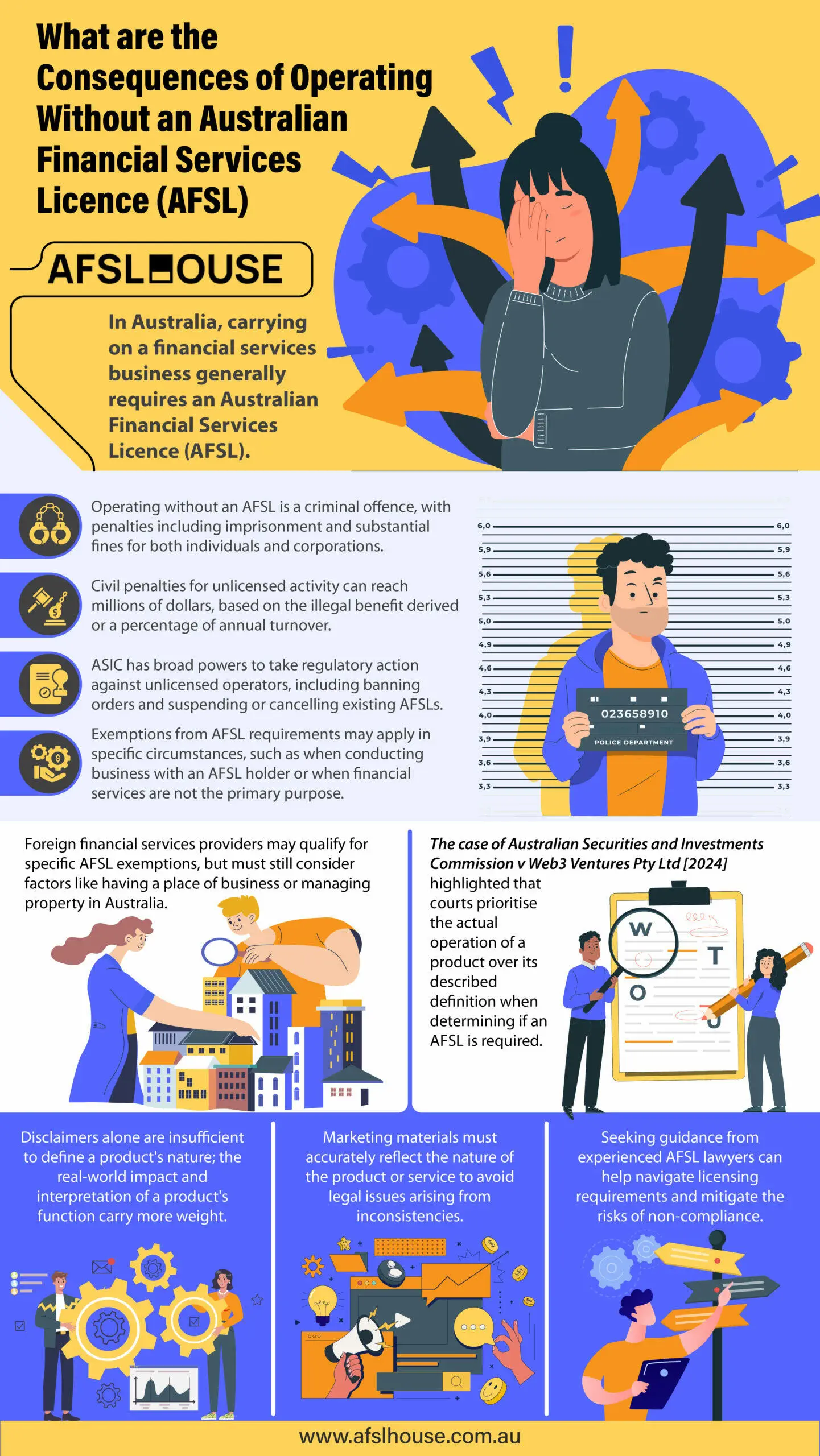

Engaging in financial services business in Australia without holding an Australian Financial Services Licence (AFSL) exposes individuals and corporations to severe legal and financial consequences. The Australian Securities and Investments Commission (ASIC) stringently enforces these requirements under the Corporations Act 2001 (Cth), protecting consumers and maintaining market integrity.

This article examines the legal framework surrounding AFSLs, outlining when a licence is required, the penalties for operating without one, and available exemptions. We will also analyse a recent case study, ASIC v Web3 Ventures [2024], to illustrate the real-world implications of non-compliance. Finally, we will address frequently asked questions to provide practical guidance for navigating this complex regulatory landscape.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Legal Requirements for Financial Services Businesses

When an AFSL is Required

Under section 911A of the Corporations Act 2001 (Cth), a person carrying on a financial services business in Australia generally requires an AFSL. This licence covers the provision of financial services related to financial products. Providing financial product advice without an AFSL is a criminal offence. For example, if an individual provides financial advice as part of their business, they generally need to apply for an AFSL.

What Constitutes “Carrying On a Financial Services Business”

The ASIC provides guidance on what constitutes “carrying on a financial services business” in Australia. Key factors include:

- Having a place of business in Australia.

- Establishing or using an office in Australia for share registration or transfer.

- Administering, managing, or dealing with property situated in Australia as an agent, legal representative, or trustee.

Case law suggests that activities considered “systematic, repetitious, or continuous” are likely to require an AFSL. Even a significant one-off financial services transaction connected with Australia may necessitate a licence. Consider a foreign company regularly providing financial product advice to Australian clients remotely. This would likely be considered carrying on a financial services business in Australia, requiring an AFSL.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Penalties for Operating Without an AFSL

Operating a financial services business in Australia without an appropriate AFSL exposes individuals and corporations to serious penalties under the Corporations Act 2001 (Cth). These penalties are designed to deter unlicensed activity and protect consumers in the financial services industry.

Criminal Penalties

Carrying on a financial services business without an AFSL is a criminal offence under section 911A of the Corporations Act 2001 (Cth). Penalties include:

- Individuals: Up to five years imprisonment and/or fines of up to $126,000.

- Corporations: Fines of up to $1,260,000.

Additionally, section 911C of the Corporations Act 2001 (Cth) imposes penalties on any individual for falsely claiming to hold an AFSL or misrepresenting licensing requirements with a maximum penalty of two years imprisonment.

Civil Penalties

Beyond criminal penalties, individuals and corporations can also face civil penalties for operating without an AFSL. These penalties, outlined in the Corporations Act 2001 (Cth), can include substantial financial repercussions:

- Individuals: The greater of $1.11 million or three times the benefit derived from the illegal activity.

- Corporations: The greater of:

- $11.1 million

- Three times the benefit derived from the illegal activity

- 10% of annual turnover (capped at $2.5 million)

These civil penalties underscore the seriousness with which Australian authorities view unlicensed financial services activities.

Additional Regulatory Actions

Furthermore, the ASIC has broad powers to take further regulatory action against those operating without an AFSL. ASIC’s powers include:

- Banning Orders: Prohibiting individuals from providing financial services or managing financial services businesses for a specified period.

- AFSL Suspension or Cancellation: ASIC can suspend or cancel an existing AFSL if the holder:

- Ceases operations

- Fails to provide services within six months of licensing

- Becomes insolvent

- Is convicted of serious fraud

- Becomes incapable of managing their affairs

These additional regulatory actions demonstrate ASIC’s commitment to maintaining the integrity of the Australian financial services industry.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Available AFSL Exemptions

Types of Exemptions

Under the Corporations Act 2001 (Cth), certain individuals and companies can be exempted from AFSL requirements. Exemptions may apply in specific circumstances, such as when conducting business with a party that already holds an AFSL or when financial services are not the primary purpose of the business.

The law provides exemptions in cases where:

- The financial service involves only the financial services provider themselves

- The service is subject to alternative regulation

- Financial services is not the sole or principal purpose of the business

- The business is conducted with an AFSL holder

Foreign Financial Services Providers

Foreign financial services providers may qualify for specific exemptions from AFSL requirements. These exemptions are designed to facilitate international business while maintaining appropriate regulatory oversight.

Key considerations for foreign providers include:

- Having a place of business in Australia

- Establishing or using an office in Australia for share registration or transfer

- Administering or managing property situated in Australia as an agent, legal representative, or trustee

ASIC defines carrying on a business in Australia as engaging in activities that are “systematic, repetitious or continuous.” However, even a one-off significant financial services transaction connected with Australia may require an AFSL.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Case Study: ASIC v Web3 Ventures [2024]

The Federal Court case Australian Securities and Investments Commission v Web3 Ventures Pty Ltd [2024] illustrates the risks of operating financial products without a proper AFSL. Web3 Ventures, operating as Block Earner, offered two products: “Earner” and “Access.” The court’s role was to determine if these products fell under the definition of financial products requiring an AFSL. Block Earner lacked an AFSL and their terms of use contained disclaimers. These disclaimers stated that they did not intend to use cryptocurrency to generate financial benefits or act as an investment for customers. However, their website advertised the “Earner” product as a means of pooling customer funds and lending them to generate a favourable yield rate.

This contradiction between their terms of use and public statements became a central issue in the case. The court found that the “Earner” product was both a managed investment scheme and an investment facility, thus requiring an AFSL. Conversely, the “Access” product was not classified as a financial product. This case provides several key takeaways for businesses operating in the financial services industry:

- Substance over Form: Courts prioritise the actual operation of a product over its described definition. How a product functions in practice carries more weight than how it’s labelled in documentation.

- Disclaimers are Insufficient: Disclaimers alone cannot define consumer behaviour or intentions. They do not override the real-world impact and interpretation of a product’s function.

- Marketing Alignment: Marketing materials must accurately reflect the nature of the product or service. Inconsistencies between marketing and operational reality can lead to legal issues.

This case serves as a reminder of the importance of accurate product classification, transparent communication, and compliance with AFSL requirements when dealing with financial products and services in Australia.

Conclusion

Operating without an AFSL carries severe consequences that can significantly impact individuals and businesses. The regulatory framework established by ASIC and the Corporations Act 2001 (Cth) aims to protect consumers and maintain the integrity of Australia’s financial services industry through strict enforcement of licensing requirements, which can include AFSL audits and investigations.

For guidance on navigating AFSL requirements and mitigating the risks of non-compliance, connect with our expert AFSL compliance lawyers at AFSL House. We offer specialised expertise in Australian financial services law, helping you understand your obligations and operate legally within the regulatory framework.

Frequently Asked Questions

Providing financial product advice, dealing in financial products, operating a registered managed investment scheme, or providing custodial or depository services generally require an AFSL. These activities fall under the definition of “carrying on a financial services business” in Australia.

Operating without an AFSL can result in criminal penalties, including imprisonment and substantial fines for both individuals and corporations. Civil penalties can also be imposed, including financial penalties based on the benefit derived from the illegal activity or a percentage of annual turnover. Additional regulatory actions, such as banning orders and license suspensions, can also be taken by ASIC. Reputational damage and loss of clients are also potential consequences.

Exemptions may apply if the financial service involves only the provider themselves, is subject to alternative regulation, is not the sole or principal purpose of the business, or is conducted with an existing AFSL holder. Foreign financial services providers may also qualify for specific exemptions. It’s essential to consult legal advice to determine eligibility.

Immediately cease providing financial services and seek legal counsel. Experienced AFSL lawyers, such as our team at AFSL House, can advise on the best course of action, which may involve applying for an AFSL, seeking an exemption, or taking other steps to rectify the situation.

The AFSL application process can be complex and time-consuming, often taking several months or longer. The timeframe depends on various factors, including the completeness of the application and the complexity of the business.

Yes, by becoming an authorised representative of an AFS licensee. This arrangement allows individuals or businesses to provide financial services under the licensee’s AFSL, subject to certain regulatory requirements.

ASIC has extensive investigative powers. They may request documents, conduct interviews, and take enforcement action if non-compliance is found. Cooperation with ASIC investigations is crucial.

Foreign financial services providers may be eligible for exemptions or may need to apply for a foreign AFSL. The specific requirements depend on the nature and scope of their activities in Australia.

AFSL holders must comply with various ongoing obligations, including maintaining adequate financial resources, meeting training and competency standards, and adhering to reporting and disclosure requirements. Ongoing compliance is essential to retain the license.

Disclaimer: All information provided in this article is strictly general in nature and is not intended to be, nor should it be relied upon as, legal advice.