Introduction

In Australia, maintaining compliance with regulatory obligations is paramount for entities that operate as financial service providers, especially those offering custodial or depository services. Under the Corporations Act 2001 (Cth), ‘Providing Custodial or Depository Services’ is explicitly defined as a financial service, making it clear that you do need an Australian Financial Services Licence (AFSL) if you intend to provide custodial services.

For businesses considering becoming a custodial or depository service provider, understanding the AFSL requirements is crucial. This guide serves as an essential resource, offering clear information on why an AFSL is necessary to provide custodial or depository services and outlining the key regulatory aspects that service providers must comply with to become authorised and operate legally as a custodian.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Understanding “Providing Custodial or Depository Services” as a Financial Service

Definition of Custodial or Depository Service under the Corporations Act

Under the Corporations Act 2001 (Cth), “providing custodial or depository service” is defined as a financial service, as outlined in section 766E(1). A provider is considered to be offering such a service when, through an arrangement, they hold a financial product or a beneficial interest in a financial product explicitly in trust for, or on behalf of, a client—or an individual formally nominated by the client.

This definition is intentionally broad to cover diverse scenarios where a provider holds financial products on behalf of clients. These arrangements can either be directly between the provider and the client or involve an intermediary party, provided the client also has an arrangement with that intermediary.

However, certain activities are expressly excluded from being classified as custodial or depository services. Some of these exclusions include:

- Operating a clearing and settlement facility

- Operating a registered scheme

- Acting as the trustee of a regulated superannuation fund, or

- Holding the assets of a registered scheme.

These exclusions ensure a clear distinction between custodial or depository services and other financial services.

Ongoing Provision of Custodial or Depository Service

The Corporations Act 2001 (Cth) further clarifies that custodial or depository services are not limited to the initial act of holding financial products—they constitute an ongoing responsibility. According to section 766E(2)(b), the continuous holding of financial products or beneficial interests is regarded as the ongoing provision of custodial or depository services after the initial arrangement has been established.

This has critical implications for entities authorised to offer these services under an AFSL. They must maintain ongoing compliance with all relevant AFSL obligations for the entire duration they hold financial products or beneficial interests on behalf of their clients.

Furthermore, the Australian Securities and Investments Commission (ASIC) imposes specific financial requirement obligations as an AFS licensee offering custodial or depository services. These financial standards are formalised under the ASIC Corporations (Financial Requirements for Custodial or Depository Service Providers) Instrument 2023/648 and are directly implemented in section 912AC of the Corporations Act 2001 (Cth).

By mandating these financial safeguards, ASIC ensures that custodial and depository service providers maintain adequate financial resources at all times. These measures enhance regulatory oversight and provide robust protection for clients placing their financial products in the care of these providers.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Why You Need an AFSL to Offer Custodial or Depository Services

Legal Requirement for an AFSL for Custodial and Depository Services

Holding an AFSL is a mandatory legal requirement for any business providing custodial or depository services in Australia. These services are defined as a financial service under the Corporations Act 2001 (Cth), and entities intending to engage in this business must obtain the relevant AFSL authorisation, a process often guided by specialised AFSL lawyers, to operate lawfully.

ASIC’s Administration and Enforcement of Financial Requirements for Custodial Service Providers

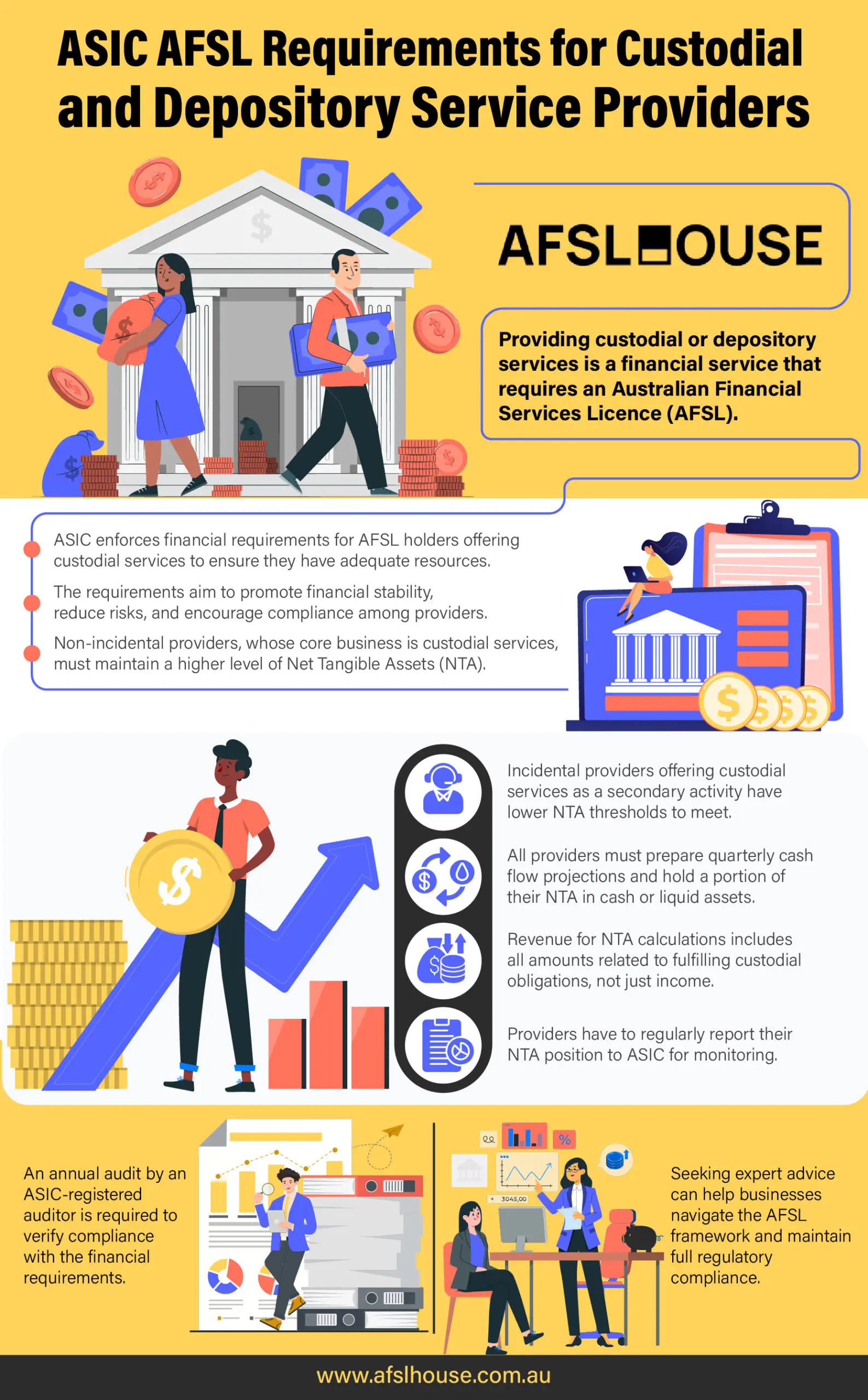

The ASIC oversees the administration and enforcement of financial requirements for AFSL holders authorised to provide custodial services. ASIC ensures that these service providers maintain adequate financial resources and comply with the obligations stipulated under the Corporations Act 2001 (Cth), particularly section 912A(1)(d).

These financial requirements are formalised in the ASIC Corporations (Financial Requirements for Custodial or Depository Service Providers) Instrument 2023/648, which updates and modifies Part 7.6 of the Corporations Act 2001 (Cth) and forms a key part of ongoing AFSL compliance and regulation. Specifically, section 912AC of the Act incorporates these financial obligations as ongoing requirements. AFSL holders must consistently meet these rigorous standards to maintain their licence and continue operating in compliance with legal and regulatory frameworks.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

ASIC’s Financial Requirements for Custodial or Depository Service Providers

Understanding the Rationale Behind ASIC’s Financial Requirements

ASIC’s financial thresholds for custodial and depository service providers are far from arbitrary—they are carefully designed to uphold key AFSL compliance and regulation objectives. Specifically, these requirements aim to:

- Ensure financial stability: Service providers must maintain sufficient financial resources to meet obligations under the Corporations Act 2001 (Cth), supporting sustainable operations and consistent service quality.

- Reduce risk during wind-ups: A robust financial buffer minimises the likelihood of disorderly or non-compliant business closures that could endanger client assets.

- Encourage compliance: These financial requirements inherently incentivise licensee owners to prioritise compliance with the regulatory framework, fostering a culture of responsibility and ethical practices.

It’s noteworthy that these financial requirements do not typically apply to entities governed by the Australian Prudential Regulation Authority (APRA). This exemption is based on APRA’s comprehensive prudential regulatory oversight, which independently ensures its participants meet similar financial stability standards.

Net Tangible Assets (NTA) Thresholds: Tailored for Service Type

A key component of ASIC’s regulatory oversight is the Net Tangible Assets (NTA) requirement, a critical measure of the financial strength of custodial and depository service providers. The NTA threshold varies depending on whether an entity is categorised as a non-incidental or incidental provider:

Non-Incidental Providers

Non-incidental providers—entities whose primary business revolves around custodial or depository services—are subject to higher NTA standards. They must maintain the greater of $10 million or 10% of their average revenue.

This elevated threshold reflects the substantial financial responsibility and operational complexity associated with their core business activities.

Incidental Providers

For incidental providers—those offering custodial services only as a secondary activity—the NTA requirements are lower. They must hold the greater of $150,000 or 10% of their average revenue.

This distinction recognises the ancillary nature of their custodial services while ensuring they still maintain a minimum level of financial stability. Importantly, ASIC defines an incidental provider as an AFS licensee whose custodial services revenue constitutes less than 10% of their total financial services revenue.

However, all licensees authorised to provide custodial or depository services must adhere to the NTA requirement, even if they are not actively providing such services. The only exception arises when another fully NTA-compliant AFS licensee holds the relevant financial products. In such cases, the incidental provider may be exempt.

Cash Flow Projections, Liquidity, and Revenue Definitions

ASIC’s financial framework extends beyond NTA thresholds, with additional requirements for cash flow management, liquidity, and revenue reporting to ensure robust financial practices:

Cash Flow Projections

All licensees must prepare quarterly, 12-month cash flow projections, which must receive formal approval. These projections must include detailed calculations and supporting documentation to validate assumptions and financial forecasts.

Liquidity Requirements

To ensure immediate financial readiness, licensees are required to hold:

- 50% of their NTA in cash or cash equivalents.

- The remaining balance in liquid assets—defined as assets convertible to cash within six months.

Cash equivalents may include cash on hand, demand deposits, or short-term investments with minimal risk, ensuring providers can address unforeseen financial challenges promptly.

Revenue Calculation

The definition of “revenue” for NTA purposes extends beyond basic income to encompass all amounts paid or payable toward fulfilling custodial or depository obligations. This comprehensive scope ensures every relevant financial inflow tied to custodial services is accounted for in the calculation.

Reporting and Audit Obligations

ASIC imposes strict reporting and audit obligations on custodial and depository service providers to promote transparency and accountability:

- Ongoing Reporting: Licensees must report their NTA position regularly to ASIC, allowing for efficient and proactive regulatory oversight.

- Annual Audit: Each licensee must secure an independent annual audit opinion from an ASIC-registered company auditor. This audit verifies compliance with financial requirements and strengthens the integrity of the broader regulatory framework.

Conclusion

For businesses intending to offer custodial or depository services, a comprehensive understanding of the AFSL framework is critical. Adherence to the regulatory obligations outlined in the Corporations Act 2001 (Cth) is not only a legal necessity but also fundamental for establishing operational integrity and safeguarding client financial products. It is important for service providers to acknowledge that ‘Providing Custodial or Depository Services’ is legally classified as a financial service, which mandates AFSL authorisation for lawful operation.

To support your business in achieving full AFSL regulatory compliance and maintaining operational effectiveness, it is crucial to seek expert guidance. Contact AFSL House’s expert lawyers to apply for an AFSL and benefit from our specialised knowledge, ensuring your operations align with the requirements of the Corporations Act 2001 (Cth).

Frequently Asked Questions

Entities such as individuals, partnerships, companies, and trustees of a trust are required to apply for an AFSL to provide custodial or depository services. Specifically, applications must be made under the individual’s name for sole traders, under the ACN or ABN for corporate trustees, and using the ARBN for foreign companies without an ABN or ACN.

Providing custodial or depository services in Australia without an AFSL is a breach of the Corporations Act 2001 (Cth) and is considered an offence, and there are significant consequences of operating without an Australian Financial Services Licence (AFSL). Furthermore, providing false or misleading information to ASIC during the AFSL application process is also an offence that can lead to application denial or licence cancellation.

An incidental provider is defined as an AFS licensee for whom custodial services are a secondary part of their financial service offerings, generating less than 10% of their revenue from these services. As incidental providers, they benefit from reduced Net Tangible Assets (NTA) requirements, needing to hold a minimum NTA of the greater of $150,000 or 10% of their average revenue, reflecting the ancillary nature of their custodial services.

The minimum NTA requirement for custodial service providers is differentiated by provider type: non-incidental providers must hold at least the greater of $10 million or 10% of their average revenue, while incidental providers are required to hold the greater of $150,000 or 10% of their average revenue. These thresholds are set to ensure financial stability relative to their primary business activities.

Assets qualifying as “cash or cash equivalents” for the liquidity requirement are those that are highly liquid and easily convertible to cash, such as cash on hand, demand deposits, and short-term, low-risk investments. These types of assets are specified to ensure licensees can readily access funds to meet immediate financial obligations.

Cash flow projections must be meticulously prepared and reviewed by licensees on a quarterly basis, covering a 12-month period. These projections, essential for demonstrating ongoing financial capability, require formal approval and must include detailed documentation of all calculations and underlying assumptions.

ASIC’s financial requirements for custodial service providers are designed to ensure financial stability, mitigate risks during business wind-ups, and incentivise regulatory compliance. These requirements ensure service providers maintain adequate financial resources, thereby protecting client assets and promoting responsible business conduct.

The ASIC Corporations (Financial Requirements for Custodial or Depository Service Providers) Instrument 2023/648 contains the detailed regulations for financial requirements, with further explanatory information available in ASIC’s Regulatory Guides, particularly Regulatory Guide 2 of the AFS Licensing Kit. These resources provide comprehensive guidance on compliance and obligations.