Introduction

Businesses providing financial or credit services in Australia must understand the distinct licensing requirements set by the Australian Securities and Investments Commission (ASIC). Holding the correct authorisation, either an Australian Credit Licence (ACL) or an Australian Financial Services Licence (AFSL), is fundamental for legal operation and compliance for any potential licensee.

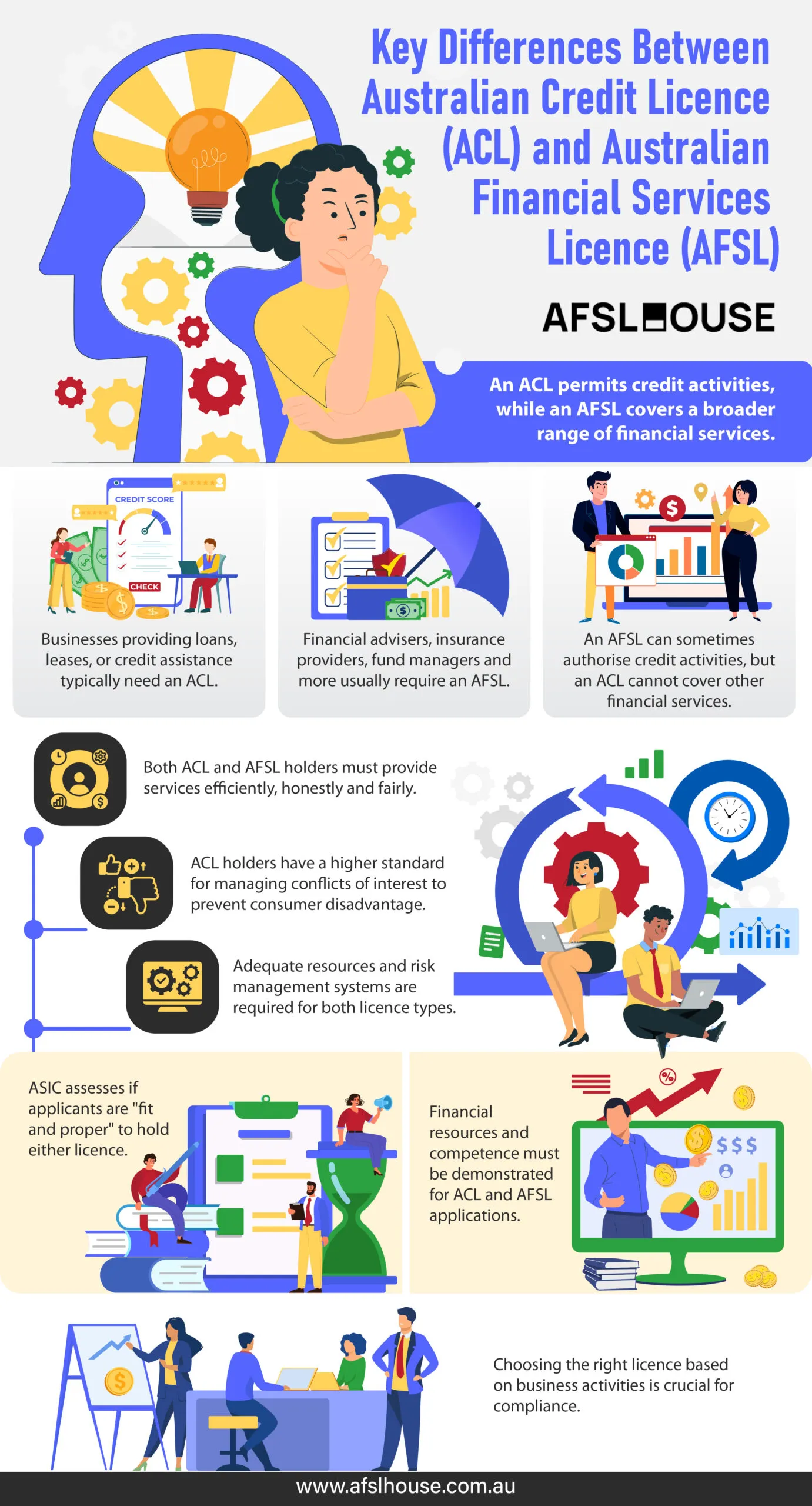

The primary distinction between these licences lies in the scope of activities they authorise; an ACL specifically permits credit activities, whereas an AFSL covers a broader range of financial services, which may sometimes include credit. This guide clarifies the key differences between the ACL and AFSL, helping businesses determine which licence is necessary for their specific operations within the Australian market.

Understanding the Australian Credit Licence

What Activities Require an Australian Credit Licence

An Australian Credit Licence is issued by ASIC under the National Consumer Credit Protection Act 2009 (Cth). This licence is generally required for individuals or businesses engaging in specific ‘credit activities’ that relate to credit contracts and consumer leases covered by the National Credit Code.

The National Consumer Credit Protection Act 2009 (Cth) defines ‘credit activity’ broadly, encompassing several key areas. Engaging in any of these activities typically necessitates holding an ACL or being an authorised credit representative of a licensee.

Key credit activities include:

- Providing credit under a credit contract: This involves being the lender or credit provider in an agreement where credit is offered to a consumer, such as banks, credit unions, or finance companies issuing loans or credit cards.

- Being a lessor under a consumer lease: This applies to businesses that hire out goods under consumer lease agreements where the consumer doesn’t have a right or obligation to purchase the goods.

- Benefiting from mortgages or guarantees: This covers holding rights as a mortgagee over property securing a credit contract or being the beneficiary of a guarantee related to a credit contract.

- Performing obligations or exercising rights: This includes acting as, or on behalf of, a credit provider, lessor, mortgagee, or beneficiary of a guarantee to perform duties or exercise rights under the relevant contract, mortgage, or guarantee (e.g., collecting repayments).

- Providing credit assistance: This involves suggesting to a consumer that they apply for, or remain in, a particular credit contract or consumer lease, or assisting them with their application for credit or a lease.

- Acting as an intermediary: This involves acting as a ‘go-between’ for a consumer and a credit provider or lessor with the purpose of securing credit or a consumer lease for that consumer.

Who Typically Needs an Australian Credit Licence

A range of businesses and individuals whose operations involve the credit activities outlined above generally need to obtain an ACL. Holding the correct licence is essential for legal operation within the Australian credit industry.

Common roles and business types that typically require an ACL include:

- Credit providers: Entities like banks, credit unions, finance companies, and pay-day lenders that offer credit contracts such as personal loans, home loans, or credit cards.

- Lessors under consumer leases: Businesses that provide goods through consumer lease arrangements, such as rental companies for furniture or appliances.

- Mortgage brokers: Intermediaries who provide credit assistance by helping consumers choose and apply for home loans.

- Finance brokers: Individuals or companies providing credit assistance or acting as intermediaries for various types of loans beyond mortgages.

- Debt collectors: Agencies that collect payments or exercise enforcement rights on behalf of a credit provider, although some state-licensed collectors may be exempt in specific circumstances.

- Mortgage managers and product designers: Entities involved in managing credit contracts or designing credit products may need a licence if their activities include arranging credit or performing obligations/exercising rights of the credit provider.

- Assignees: Businesses that purchase debts (debt buyers) and become the legal owner of the rights under the credit contract, mortgage, or guarantee.

Understanding the Australian Financial Services Licence

What Activities Require an Australian Financial Services Licence

An Australian Financial Services Licence is mandated under section 911A(1) of the Corporations Act 2001 (Cth) for any person or entity carrying on a financial services business in Australia. The licence must specifically cover the types of financial services being provided.

The range of activities defined as ‘financial services’ requiring an AFSL is extensive and includes:

- Providing financial product advice to clients, covering areas like investments, superannuation, and insurance

- Dealing in financial products, which involves actions such as buying or selling shares or derivatives for clients

- Making a market for financial products

- Operating registered schemes, such as managed investment schemes or superannuation funds

- Providing custodial or depository services

- Offering traditional trustee company services

- Operating the business and conducting the affairs of a corporate collective investment vehicle (CCIV)

- Providing a crowd-funding service

- Providing claims handling and settling services, particularly in relation to insurance products

- Providing a superannuation trustee service

Speak with an AFSL Lawyer Today

Request a Consultation to Get Started.

Who Typically Needs an Australian Financial Services Licence

A diverse range of businesses and individuals involved in the financial sector typically need to obtain an AFSL. Holding the correct licence ensures they meet regulatory standards set by ASIC.

Common examples of those requiring an AFSL include:

- Financial advisers: Individuals or firms providing financial product advice on investments, superannuation, or insurance

- Insurance providers and brokers: Businesses offering general or life insurance products or acting as brokers

- Claims handling services: Entities managing insurance claims on behalf of policyholders

- Fund managers: Businesses operating registered schemes like managed funds

- Managed Discretionary Account (MDA) operators and advisers: Those providing portfolio management services through discretionary accounts

- Money remitters: Businesses facilitating domestic or international fund transfers

- Over-the-Counter (OTC) derivatives market makers: Entities facilitating direct trading of derivatives between parties

- Robo-advisers: Businesses using technology and algorithms to provide automated financial advice

- Cryptocurrency service providers: Certain businesses involved in providing services related to cryptocurrencies may also fall under AFSL requirements

Comparing Scope and Authorisation Between Australian Credit Licence & Australian Financial Services Licence

Services Covered by Australian Credit Licence VS Australian Financial Services Licence

The fundamental difference between an ACL and an AFSL lies in the scope of activities each licence authorises. An ACL specifically permits the licensee to engage in ‘credit activities’ as defined under the National Consumer Credit Protection Act 2009 (Cth).

These credit activities typically include:

- Providing credit under a credit contract

- Offering credit assistance, such as helping a consumer apply for a loan or suggesting a particular credit contract

- Acting as an intermediary between a credit provider and a consumer (credit broking)

- Being a lessor under a consumer lease

In contrast, an AFSL, governed by the Corporations Act 2001 (Cth), authorises a much broader range of ‘financial services’. The specific services an AFSL holder can provide depend on their authorisations.

Common financial services requiring an AFSL include:

- Providing financial product advice

- Dealing in financial products (like shares or insurance)

- Making a market for financial products

- Operating a registered scheme (such as a managed fund)

- Providing custodial or depository services

Therefore, the ACL has a narrower focus solely on credit, while the AFSL covers a wider spectrum of financial services, which may sometimes include credit.

Can an Australian Financial Services Licence Cover Credit Activities

Yes, an AFSL can authorise the holder to provide financial services that include credit services. This means a business holding an AFSL with the appropriate authorisations may be permitted to engage in certain credit activities without needing a separate ACL.

However, the reverse is not true. An ACL only permits the licensee to engage in credit activities. It does not authorise the holder to provide the broader range of financial services covered by an AFSL, such as financial product advice or dealing in securities. This distinction highlights a key difference in the scope and flexibility of the two licences.

Speak with an AFSL Lawyer Today

Request a Consultation to Get Started.

Key Obligations for Australian Credit Licence & Australian Financial Services Licence Holders Compared

General Conduct Obligations Including Acting Efficiently Honestly & Fairly

Both ACL and AFSL holders are bound by a core general obligation regarding how they conduct their business. This fundamental requirement mandates that licensees provide their respective services “efficiently, honestly, and fairly.”

This obligation is enshrined in both regulatory frameworks:

- For ACL holders, it is specified under section 47(1)(a) of the National Consumer Credit Protection Act 2009 (Cth).

- For AFSL holders, it is outlined in section 912A(1)(a) of the Corporations Act 2001 (Cth).

This shared standard underscores the expectation that all licensed entities, whether dealing in credit or broader financial services, must operate with integrity and professionalism. While the interpretation of “efficiently, honestly, and fairly” can be contextual, it serves as a baseline for ethical conduct across both licensing regimes.

A Key Distinction in Managing Conflicts of Interest

Both ACL and AFSL holders must manage conflicts of interest, but the specific legal requirements differ, presenting a notable distinction between the two licences.

For AFSL holders:

- Section 912A(1)(aa) of the Corporations Act 2001 (Cth) requires them to have adequate arrangements in place to manage conflicts of interest that may arise.

In contrast, ACL holders face a higher standard under section 47(1)(b) of the National Consumer Credit Protection Act 2009 (Cth). They must have arrangements to ensure that consumers are not disadvantaged by any conflict of interest related to the credit activities the licensee provides. This places a greater emphasis on the consumer outcome, requiring ACL holders to actively prevent client disadvantage resulting from conflicts.

Resource & Compliance System Requirements

Both ACL and AFSL holders must demonstrate they have adequate resources and systems to support their licensed activities, although the specifics are detailed in separate legislation.

AFSL holders must comply with sections 912A(1)(d) and (h) of the Corporations Act 2001 (Cth), which require:

- Adequate financial, technological, and human resources.

- Adequate risk management systems.

ASIC provides guidance that these resources and systems should be tailored to the nature, scale, and complexity of the specific financial services business.

Similarly, ACL holders are required by section 47(1)(l) of the National Consumer Credit Protection Act 2009 (Cth) to have:

- Adequate resources, including financial, technological, and human resources.

- Adequate risk management systems.

Both licence types necessitate robust compliance processes and systems to ensure adherence to all relevant legislative obligations. Licensees must be able to demonstrate the adequacy of these resources and systems to ASIC.

ASIC Assessment and the Fit & Proper Person Test

When applying for either an ACL or an AFSL, ASIC undertakes a thorough assessment process. A critical part of this assessment for both licence types involves determining if the applicant is a “fit and proper” person to hold the licence.

For this determination, ASIC must be satisfied that there is no reason to believe the applicant is likely to contravene the general obligations associated with the licence. The fit and proper test evaluates several key attributes of the applicant, along with its officers and management, including:

- Competence

- Good character

- Diligence

- Honesty

- Integrity

- Judgement

Additionally, ASIC assesses whether the person is disqualified by law or if any conflicts of interest would materially risk the proper performance of their role.

Financial Resources & Competence Requirements

Both ACL and AFSL applications require demonstrating adequate resources and competence to carry out the proposed activities. These requirements ensure that licensees under both regimes have the capacity and capability to meet their ongoing obligations.

For an AFSL application, the process involves:

- Demonstrating sufficient financial resources to carry on the proposed business (unless regulated by APRA)

- Showing competence to conduct the specific kind of financial services business specified in the application

Similarly, obtaining an ACL requires:

- Proving adequate financial resources are available

- Demonstrating the necessary competence and qualifications to engage in the credit activities covered by the licence application

Speak with an AFSL Lawyer Today

Request a Consultation to Get Started.

Conclusion

Understanding the Australian regulatory landscape requires grasping the distinct roles of the ACL for credit activities and the AFSL for broader financial services. Choosing the correct licence, whether acquiring anACL or applying for AFSL, based on your specific business activities and understanding the associated obligations is essential for compliance and legal operation for any potential licensee.

If you need assistance determining whether your business requires an ACL or an AFSL, or managing the complexities of the licence application process, contact AFSL House today. Our experts specialise in financial services law and can provide the trusted guidance needed to ensure your business holds the appropriate Australian licence and meets all regulatory requirements.

Frequently Asked Questions

The primary difference lies in the scope of activities each licence authorises; an ACL is specifically for engaging in ‘credit activities’, while an AFSL covers a broader range of ‘financial services’, which can sometimes include credit. An ACL only permits credit activities, whereas an AFSL allows for financial services generally.

If your business solely engages in credit activities like providing loans, you generally need an ACL. An ACL is specifically designed for entities whose main business involves credit activities as defined under the National Consumer Credit Protection Act 2009 (Cth).

Yes, an AFSL holder can provide certain credit services if their licence authorisations permit it, without needing a separate ACL. However, an ACL only authorises the licensee to engage in credit activities.

Credit activities under the ACL regime, defined by the National Consumer Credit Protection Act 2009 (Cth), include providing credit, offering credit assistance (like suggesting or helping with loan applications), acting as an intermediary, being a lessor under a consumer lease, or performing obligations/exercising rights of a credit provider. Engaging in these activities typically requires an ACL or authorisation from a licensee.

Financial services under the AFSL regime, governed by the Corporations Act 2001 (Cth), encompass providing financial product advice, dealing in financial products (like shares), operating registered schemes, and providing custodial services, among others. This scope is broader than the credit activities covered by an ACL.

No, the obligations for managing conflicts of interest differ; ACL holders must ensure consumers are not disadvantaged by conflicts (s47(1)(b) National Consumer Credit Protection Act 2009 (Cth)), while AFSL holders must have adequate arrangements to manage them (s912A(1)(aa) Corporations Act 2001 (Cth)). The ACL standard places a greater emphasis on preventing consumer disadvantage.

Yes, both ACL holders (under s47(1)(a) National Consumer Credit Protection Act 2009 (Cth)) and AFSL holders (under s912A(1)(a) Corporations Act 2001 (Cth)) must provide their respective services efficiently, honestly, and fairly. This is a core general conduct obligation shared by both types of licensee.

You can verify if a business holds an ACL or an AFSL by searching the registers on the ASIC website. Use ASIC’s ‘Professional Registers Search’ or the ‘National Credit Licence Register’ for an ACL, and the ‘Financial Advisers Register’ for an AFSL, particularly for advice providers.

Suggesting a consumer apply for a specific loan with a particular credit provider generally constitutes ‘credit assistance’, requiring an ACL or authorisation as an authorised credit representative. Limited exemptions, like ‘mere referral’ under specific conditions including disclosure of benefits, may apply (regs 25(2), 25(2A), 25(5) National Consumer Credit Protection Regulations 2010 (Cth)).