Introduction

Contracts for Difference, or CFDs, let traders make bets on how asset prices will change, without needing to own the actual assets. This means traders can enjoy the flexibility and extra power that CFDs bring. Both beginner and savvy investors can potentially earn money whether prices are climbing high or dropping low.

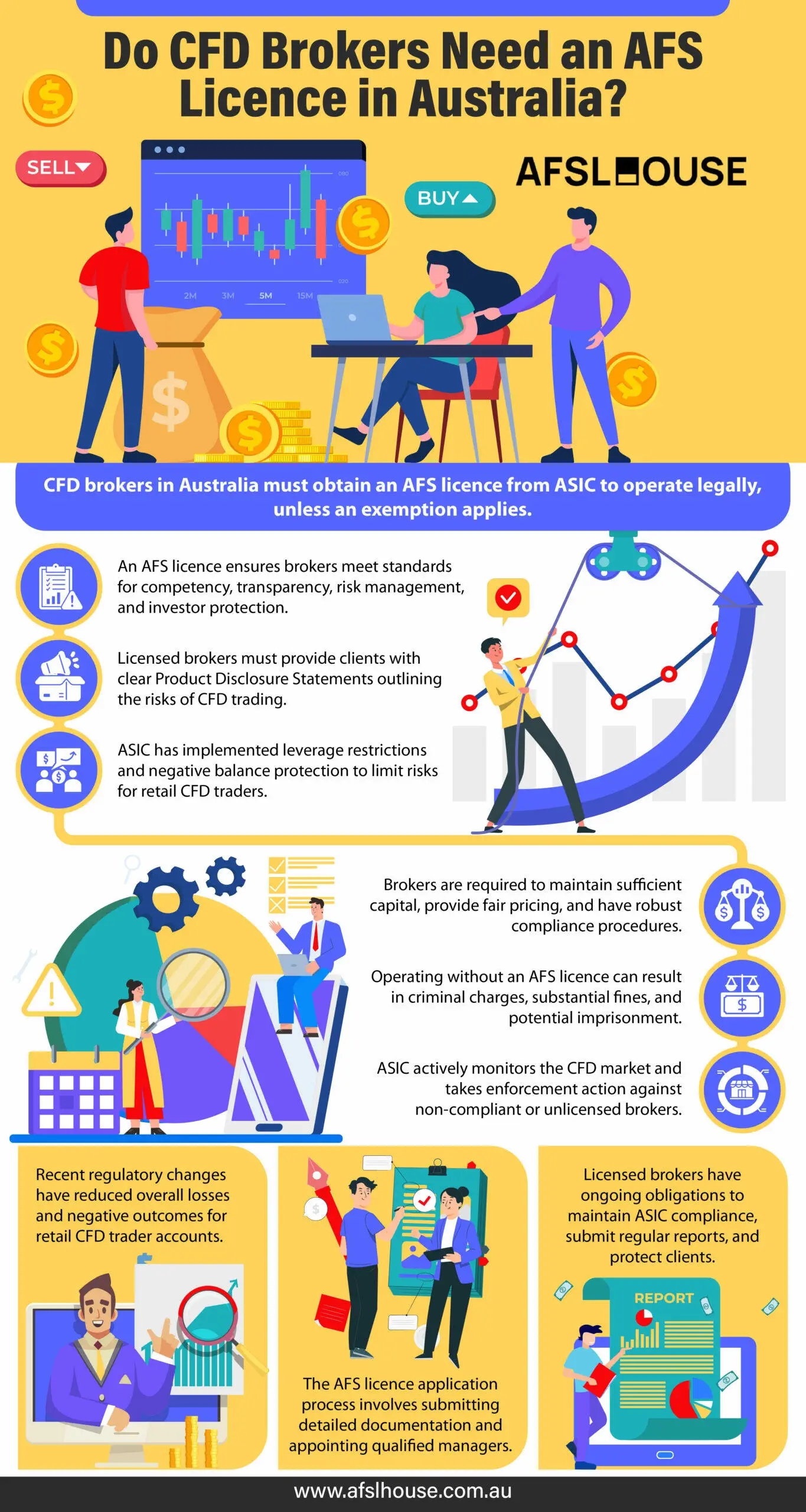

In Australia, CFD trading is strictly regulated by the Australian Securities and Investments Commission (ASIC). ASIC requires all entities providing CFD-related financial services to hold an Australian Financial Services (AFS) Licence. This licensing framework ensures brokers meet competency standards, operate transparently, and adhere to AFSL compliance and investor protection measures.

For brokers, securing an AFS Licence is a legal necessity, while for investors, it serves as a mark of trust and security. Understanding this regulatory requirement is essential for navigating Australia’s CFD market safely and compliantly.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Regulatory Framework for CFDs in Australia

Australian Securities and Investments Commission (ASIC)

CFDs are classified as derivatives under the Corporations Act 2001 (Cth), making them regulated financial products. This classification imposes strict legal obligations on entities offering CFD-related services, including:

- Holding an AFSL, unless an exemption applies

- Operating efficiently, honestly, and fairly within the financial services industry under the Act’s regulatory framework

The Act also mandates that CFD brokers provide clients with a Product Disclosure Statement (PDS). These documents must include:

- Clear risk disclosures

- Comprehensive explanations of potential outcomes

By complying with these legal requirements, CFD brokers contribute to a transparent and trustworthy financial market, reinforcing ASIC’s objectives of consumer protection and market integrity.

Corporations Act 2001 (Cth)

Because CFDs are classified as derivatives under the Corporations Act 2001 (Cth), they are regulated financial products. This classification imposes strict legal obligations on entities offering CFD-related services, including:

- Holding an AFSL, unless an exemption applies

- Operating efficiently, honestly, and fairly within the financial services industry under the Act’s regulatory framework

Moreover, the Act mandates that CFD brokers provide clients with a Product Disclosure Statement (PDS). These documents must include:

- Clear risk disclosures

- Comprehensive explanations of potential outcomes

By complying with these legal requirements, CFD brokers contribute to a transparent and trustworthy financial market, reinforcing ASIC’s objectives of consumer protection and market integrity.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Why CFD Brokers Need an AFS Licence

Legal Requirements

The Corporations Act 2001 (Cth) classifies CFDs as derivatives, subjecting them to strict regulatory oversight. As a result, CFD brokers in Australia are legally required to obtain an AFSL, unless an exemption applies. This licensing requirement ensures brokers operate within a legal and ethical framework, promoting market integrity and investor protection.

To comply with ASIC regulations, licensed CFD brokers must meet several key AFSL compliance obligations:

- Capital Adequacy: Maintain sufficient financial resources to ensure stability and sustainability.

- Fair and Transparent Pricing: Provide clients with clear and accurate market pricing.

- Risk Management Procedures: Implement robust strategies to mitigate financial risks for brokers and traders.

- PDS: Offer comprehensive documentation outlining the risks and features of CFD trading, enabling informed decision-making by investors.

Section 912A of the Corporations Act 2001 (Cth) also mandates that AFSL holders conduct their business efficiently, honestly, and fairly. This reinforces the need for CFD brokers to uphold high standards of integrity and professionalism, ensuring compliance with regulatory requirements and fostering trust in the financial markets.

Exemptions and Exceptions

While the general rule mandates that CFD brokers obtain an AFS Licence, certain exemptions exist under Australian law. These exemptions allow specific entities to operate without a licence under defined conditions, ensuring regulatory flexibility while maintaining oversight.

One key example of exemptions for foreign CFD and FX brokers is outlined in Regulation 7.6.02AG of the Corporations Regulations 2001, which permits them to operate in Australia without an AFS Licence, provided they exclusively deal with professional investors. This exemption facilitates the entry of established international brokers while ensuring retail clients remain protected under ASIC regulations.

Another exception applies to representatives of existing AFS Licence holders. Authorised representatives operating under a licensed entity may not need to obtain a separate AFS Licence, as their activities fall under the scope of their licensee’s authorisation. This provision enables smaller firms and individual professionals to engage in CFD-related services without undergoing a separate licensing process.

Consumer Protection Obligations

Holding an AFS licence ensures consumer protection in the CFD trading industry. Licensed brokers must comply with strict regulatory requirements to safeguard retail investors from excessive risks and ensure transparency in financial services.

One key requirement is the provision of PDS. These documents outline the risks, features, and complexities of CFD trading, helping investors make informed decisions. A well-structured PDS ensures that traders understand the potential for significant losses and the high-risk nature of CFDs.

Additionally, ASIC mandates specific client protection measures for AFS Licence holders, including:

- Negative Balance Protection – Prevents traders from losing more than their initial investment, shielding them from excessive financial exposure.

- Leverage Restrictions – Limits the number of investors who can borrow for CFD trading, reducing the risk of substantial losses.

Furthermore, licensed brokers must meet strict disclosure obligations, ensuring all marketing materials, advertisements, and client communications are clear, accurate, and not misleading.

Market Integrity and Trust

An AFS Licence is fundamental to maintaining market integrity and fostering investor trust in the CFD trading industry. Licensed brokers demonstrate their commitment to fair, transparent, and ethical trading practices by complying with ASIC’s regulatory standards. This regulatory framework reassures investors that their broker operates under strict oversight, reducing the risk of fraudulent activities and unethical conduct.

ASIC enforces compliance through regulatory actions against unlicensed brokers, reinforcing its dedication to a secure and reliable financial services industry. These enforcement measures deter non-compliance, ensuring only brokers who meet ASIC’s rigorous standards can operate in the market.

Moreover, obtaining an AFS Licence signifies that a broker has met stringent requirements regarding:

- Financial Stability – Ensuring sufficient capital to manage market fluctuations.

- Risk Management – Implementing safeguards to protect investors from excessive losses.

- Operational Competence – Demonstrating the ability to conduct business efficiently and fairly.

This level of oversight enhances investor confidence, assuring licensed brokers are reliable, well-regulated, and committed to maintaining high market standards.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Key AFS Licence Requirements for CFD Brokers

Compliance with ASIC Regulations

CFD brokers must comply with ASIC regulations to obtain and maintain an AFS Licence. This includes meeting capital adequacy requirements, ensuring fair and transparent pricing, and implementing effective risk management procedures.

Client Protection Measures

ASIC mandates several client protection measures to safeguard retail traders. These include negative balance protection, ensuring clients cannot lose more than their initial investment. Additionally, leverage restrictions limit the amount of borrowed capital available to traders, and disclosure obligations require brokers to provide clear information about the risks involved in CFD trading.

Obligation to Act Efficiently, Honestly, and Fairly

Under Section 912A of the Corporations Act 2001 (Cth), AFS licensees have a legal obligation to act efficiently, honestly, and fairly. This obligation ensures that CFD brokers operate with integrity, prioritising the best interests of their clients and maintaining high ethical standards.

Product Disclosure Statements (PDS)

CFD brokers must provide their clients with comprehensive PDS. These statements are essential for providing comprehensive risk disclosures and helping clients understand the potential risks of CFD trading. A well-prepared PDS helps ensure investors are fully informed before trading decisions.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

ASIC’s Oversight and Regulatory Changes

Product Intervention Orders

ASIC has implemented Product Intervention Orders to regulate CFD trading in Australia. Introduced in 2021, these orders impose leverage restrictions to protect retail traders from excessive losses. By imposing stricter controls on CFD products, ASIC ensures that brokers adhere to fair trading practices and prioritise investor protection.

Leverage Limitations and Risk Management

ASIC has established leverage ratio restrictions to mitigate the risks associated with leveraged trading. These limitations vary based on the type of asset being traded:

- 30:1 for major currency pairs

- 20:1 for minor currency pairs, gold, or major stock indices

- 10:1 for commodities (excluding gold) or minor stock indices

- 5:1 for shares or other assets

- 2:1 for crypto-assets

Additionally, ASIC has standardised margin close-out rules to prevent clients from incurring excessive losses. These measures ensure that traders cannot lose more than their initial investment, enhancing overall market stability.

Implementation Timeline

The Product Intervention Orders were initially enforced from March 29, 2021, and have been extended for five years, until May 23, 2027. This extension demonstrates ASIC’s ongoing commitment to regulating the CFD market and adapting to evolving financial landscapes. The timeline allows for gradual compliance by CFD brokers and provides a clear framework for regulatory adherence.

Impact Assessment

Since the implementation of these ASIC regulatory changes, there has been a noticeable reduction in aggregate net losses among retail clients. The number of loss-making retail client accounts has decreased, and occurrences of margin close-outs and negative balances have declined significantly. These outcomes indicate that ASIC’s measures effectively safeguard investors and maintain market integrity.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Enforcement and Consequences of Operating Without an AFS Licence

Penalties for Non-Compliance

Operating a CFD brokerage without an AFS Licence is a criminal offence under Australian law. This violation can lead to significant penalties, including substantial fines and imprisonment for responsible individuals. Non-compliant brokers may face criminal and civil penalties, with fines reaching thousands or even millions of dollars, depending on the severity of the infringement and the duration of non-compliance. Additionally, individuals in charge of unlicensed operations could face personal liability, including potential imprisonment.

Case Studies

ASIC has actively enforced penalties and sanctions against CFD brokers that fail to comply with regulatory standards, reinforcing its commitment to market integrity and investor protection. A notable example is the cancellation of FXOpen AU’s AFS Licence, which resulted from serious concerns about its financial services operations.

FXOpen AU, headquartered in the UK with offices in Australia, was found to have significant deficiencies in its human resources and compliance with financial obligations. These failures ultimately led to the revocation of its AFS licence, preventing it from continuing operations under Australian financial law.

This case highlights ASIC’s strict regulatory oversight, ensuring brokers adhere to high professional and ethical standards. By taking decisive action against non-compliant entities, ASIC deters unauthorised operations and safeguards the integrity of Australia’s financial markets.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

How to Apply for an AFS Licence for a CFD Brokerage

Current Application Process and Digital Portal

ASIC has streamlined the AFSL application process through a mandatory ASIC Regulatory Portal. This digital platform is now the required channel for all new applications and is designed to enhance efficiency and accessibility with a user-friendly interface.

Key features of the portal include:

- Pre-filled applicant information where details are already known to ASIC, minimising manual data entry.

- Tailored questions that adapt based on the applicant’s specific business model, ensuring a more relevant and efficient application process.

Required Documentation and Responsible Managers

When applying for an AFSL, CFD brokers must provide comprehensive information and documentation to demonstrate their capability to comply with ASIC’s regulatory standards.

- Online Application Information: The application lodged via the ASIC Regulatory Portal requires detailed information about the business, including:

- A comprehensive business description outlining operations and target markets.

- Details of the firm’s compliance measures and risk management framework.

- Evidence of adequate financial resources to sustain business activities.

- Supporting Documents: The primary supporting documents required to be uploaded are People Proofs for the nominated Responsible Managers (RMs). These proofs must demonstrate the RMs’ experience, qualifications, and suitability for the role of a Responsible Manager in overseeing the financial services offered.

Eligibility Criteria

To qualify for an AFS Licence, firms must meet specific organisational competence and financial requirements in line with Section 912A of the Corporations Act 2001 (Cth). Key eligibility criteria include:

- Organisational Competence: Firms must demonstrate sufficient knowledge and skills to provide financial services and the products they intend to offer.

- Financial Requirements: Adequate capital reserves are necessary to ensure financial stability and the capability to meet client obligations.

- Responsible Managers: At least one RM must meet the necessary qualifications and experience to oversee the firm’s financial services operations.

Ongoing Compliance Obligations

Maintaining an AFS licence requires continuous ongoing AFSL compliance with ASIC’s regulatory standards. Ongoing obligations include:

- Regular Reporting: Licensed brokers must submit periodic reports to ASIC detailing their financial status and compliance with licence conditions.

- Adherence to Regulatory Standards: Firms must continuously implement and update their risk management procedures to align with evolving regulations.

- Disclosure Obligations: Providing clear and comprehensive PDS to clients is mandatory, ensuring transparency about the risks and features of CFD trading.

- Client Protection Measures: Brokers must enforce measures such as negative balance protection and leverage restrictions to safeguard retail traders.

Conclusion

Holding an AFS licence is a fundamental requirement for Contracts for Difference (CFD) brokers operating in Australia. It ensures AFSL compliance, financial stability, and transparent trading practices, reinforcing investor confidence. This licence not only validates a broker’s ability to offer financial products responsibly, but also protects retail investors by mandating comprehensive disclosure and robust risk management practices.

To ensure your brokerage remains compliant and benefits from ASIC’s regulatory oversight, contact our expert lawyers to apply for your AFSL and leverage our proven solutions to secure your licence efficiently.

Frequently Asked Questions

An Australian Financial Services (AFS) Licence is required for Contracts for Difference (CFD) brokers, as CFDs are classified as derivatives under Australian law and are regulated by the Corporations Act 2001 (Cth). This licence ensures brokers operate within legal and ethical boundaries and comply with ASIC’s regulatory standards.

To obtain an AFS Licence, CFD brokers must comply with ASIC regulations, implement client protection measures, act efficiently, honestly, and fairly, and provide comprehensive Product Disclosure Statements (PDS). These requirements include maintaining capital adequacy, ensuring fair pricing, and implementing effective risk management procedures.

Operating a CFD brokerage without an AFS Licence is a criminal offence that can result in significant penalties, including fines and imprisonment for those responsible. ASIC actively pursues enforcement actions against non-compliant brokers to maintain market integrity and protect consumers.

ASIC oversees CFD brokers by implementing regulatory measures such as Product Intervention Orders, limiting leverage, and enforcing risk management standards. The regulator monitors compliance through regular assessments and can act against brokers who fail to meet their obligations.

Yes, under Regulation 7.6.02AG of the Corporations Regulations 2001, foreign CFD and FX brokers are exempted from holding an AFS Licence if they exclusively deal with professional investors. Additionally, authorised representatives of existing AFS Licence holders may not need a separate licence.

CFD brokers must apply for an AFS Licence by lodging an online application through the ASIC Regulatory Portal. This portal is the required and fully operational system for all applications, involving the submission of detailed information and supporting documents, such as People Proofs for Responsible Managers.

Under an AFS Licence, client protection measures include negative balance protection, leverage restrictions, and comprehensive disclosure obligations. These measures ensure that retail traders are safeguarded against excessive losses and can access clear information about the risks associated with CFD trading.

Yes, a foreign CFD broker can operate in Australia without an AFS Licence if they exclusively serve professional investors and meet the conditions outlined in Regulation 7.6.02AG of the Corporations Regulations 2001. This exemption allows established international brokers to enter the Australian market while ensuring regulatory oversight remains for retail clients.

ASIC has introduced several regulatory changes, including Product Intervention Orders to limit leverage and protect retail traders, and has launched a new digital portal to streamline the AFS Licence application process. These changes aim to enhance consumer protection and ensure CFD brokers adhere to stricter risk management and compliance standards.