Introduction

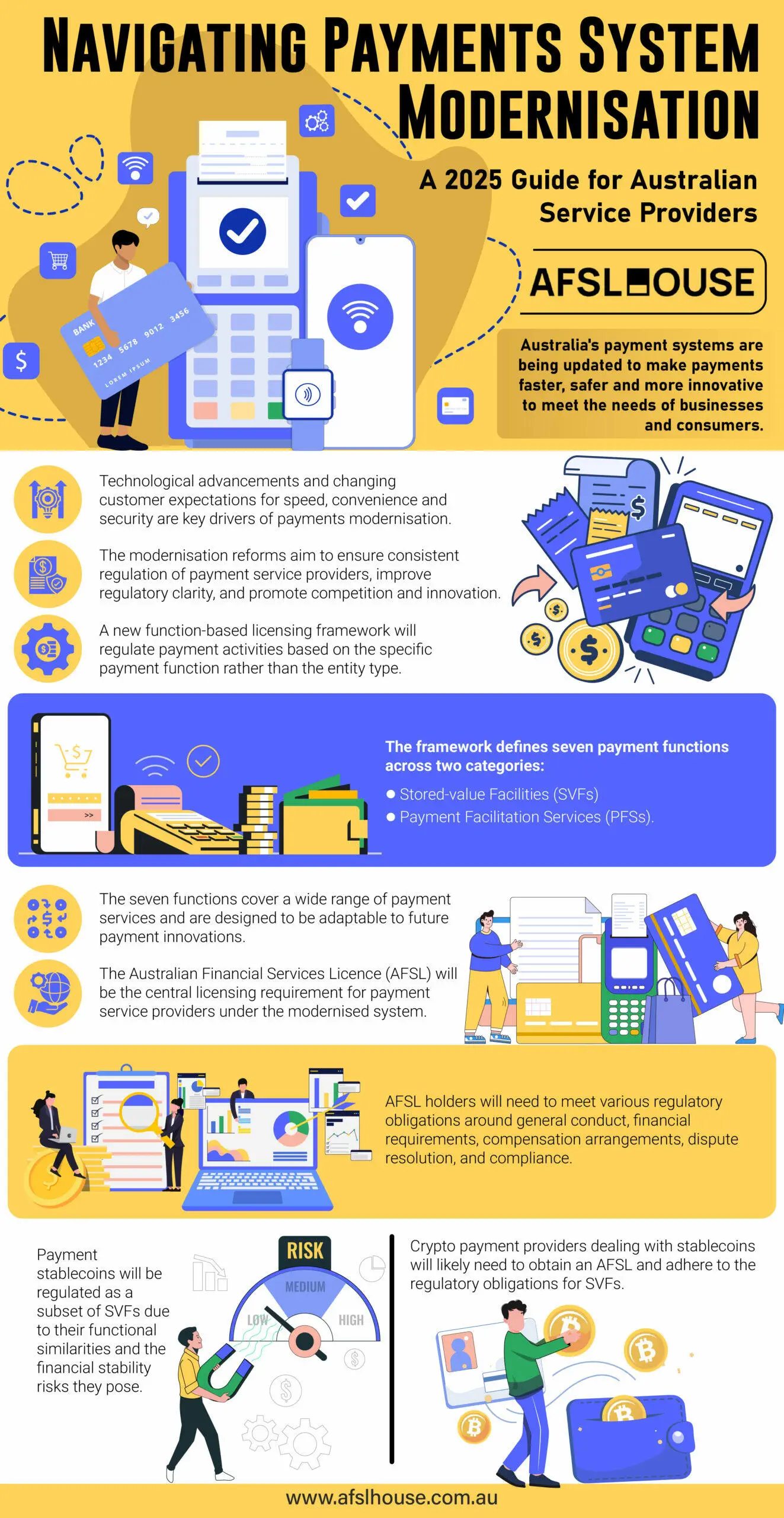

Australia’s payments landscape is undergoing significant payments system modernisation, impacting all payment service providers (PSPs) operating within the Australian financial system. This system modernisation ensures a more efficient, secure, and innovative payment ecosystem that meets the evolving needs of businesses and consumers within Australia. Driven by technological advancements and changing customer expectations, these reforms are crucial for maintaining a competitive and robust financial service sector.

Australian service providers must understand and adapt to the new payment regulatory framework. This guide provides a comprehensive overview of the key aspects of payments system modernisation, focusing on the new licensing framework for PSPs and the implications of obtaining an Australian Financial Services Licence (AFSL) to conduct payment services. It will further explore the proposed list of payment functions and the regulatory obligations PSPs will need to navigate in 2025 and beyond.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Decoding Payments System Modernisation in Australia

The Imperative for Modernisation

Australia’s payments system is undergoing modernisation to ensure its regulatory framework is fit for purpose in today’s economy. This modernisation is essential to address policy issues arising from new payment technologies. Several key factors drive the move towards modernisation. Technological advancements are a significant driver, with innovations requiring payment systems to adapt and integrate new solutions.

Evolving customer expectations also play a crucial role, as consumers now demand faster, more convenient, and secure payment options. Traditional payment infrastructures cannot meet these demands, necessitating an upgrade. Furthermore, a fit-for-purpose regulatory framework is critical to ensure consistent and appropriate regulation of PSPs

Key Objectives of the Modernisation Reforms

The payments system modernisation initiative has numerous key objectives, including:

- Ensuring consistent and appropriate regulation of PSPs based on their specific payment function. This function-based approach is a core element of the reforms.

- Improving regulatory certainty for PSPs. This involves clarifying when a payment service requires a licence and what regulatory obligations are associated with it.

- Modernisation also seeks to support a more level playing field for PSPs, promoting greater competition, diversity, and innovation within the payment ecosystem.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Unveiling the New Payments Licensing Framework for 2025

A Shift Towards Function-Based Licensing

Australia’s payments system modernisation is transitioning towards a function-based licensing framework for PSPs. This marks a significant shift from the previous approach, which focused on regulating ‘non-cash payment facilities’.

The new framework is designed to regulate payment activities based on the specific payment function performed rather than the type of entity providing the service. By doing so, it aims to ensure consistent and appropriate regulation of payment services, regardless of the provider.

Furthermore, this shift to function-based licensing is intended to bring greater regulatory certainty to PSPs. By clearly defining and regulating specific payment functions, the framework clarifies when a licence is required and outlines the associated regulatory obligations.

This clarity is expected to foster innovation and competition within the payments landscape. Providers will benefit from a clearer understanding of the regulatory requirements linked to different payment activities, enabling them to navigate the market more effectively.

Exploring the Seven-Defined Payment Functions

The new payments licensing framework is built around seven defined payment functions, categorised under two main types: Stored-value Facilities (SVFs) and Payment Facilitation Services (PFSs). These functions are comprehensive, capturing the diverse range of payment services offered in Australia and adaptable to future innovations in the payments industry.

The seven proposed payment functions are:

- Issuance of payment accounts or facilities (‘traditional SVFs’):

This function covers providers of payment accounts or facilities that store value for more than two business days and can be used for making payments. Examples include digital wallets that store value, issuers of prepaid accounts, and entities currently regulated as Purchased Payment Facilities. - Issuance of payment stablecoins (‘payment stablecoin SVFs’):

This function relates to issuers of payment stablecoins that store value and control the total supply of stablecoins through issuance and redemption activities. Payment stablecoin issuers are the potential entities captured under this function. - Issuance of payment instruments:

This function captures issuers of payment instruments unique to a customer that can be used to pay transactions or provide instructions on their account or facility. Potential entities include issuers of payment instruments such as digital and physical cards, cheques, and Buy Now Pay Later providers that issue virtual cards. - Payment initiation services:

These services allow the instruction of a payment transaction at the request of the customer (payer or payee) concerning a payment account or facility held at another PSP or from another source of value or a credit facility. Examples include recurring payment services and third-party payment initiation services. - Payment facilitation services:

This function encompasses services that enable payment instructions to be transferred (facilitation), verify customer credentials (authentication), authorise payments, and process payment instructions. Entities such as pass-through digital wallets, merchant acquirers, card issuers, payment gateways and processors, and payment routing providers fall under this category. - Payments clearing and settlement services:

This function applies to services for clearing or settling payment obligations or exchanging payment messages to clear or settle payment obligations. This includes clearing and settling account-to-account payments. Payments clearing and settlement providers are the potential entities captured. - Money transfer services:

These services involve sending or receiving money overseas or within Australia for a customer, either through creating a payment account or without one. Remittance service providers and domestic money transfer providers are examples of entities that provide these services.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

AFS Licensing: Your Gateway to Compliance in the Modernised System

AFSL as the Cornerstone of the New Regulatory Regime

The AFSL is set to become the central element for PSPs navigating the modernised payments landscape. This shift emphasises regulating payment functions, ensuring that entities providing specific payment services are appropriately licensed and compliant.

For PSPs, especially those dealing with crypto-based payment arrangements like payment stablecoins, obtaining an AFSL is essential for operating within the Australian payments system. The Australian government’s reforms aim to create a consistent and appropriate regulatory environment for PSPs, with the AFSL framework identified as the cornerstone of this new regulatory regime.

By leveraging the existing financial services framework, the AFSL ensures that payment services are regulated consistently with other financial services. Under the new framework, every Payment Service Provider must hold a ‘base licence’ specifying their authorised functions.

Navigating Regulatory Obligations Under an AFSL

Under the modernised system, obtaining an AFSL introduces a range of regulatory obligations that PSPs must navigate to ensure compliance. These obligations are designed to address various risks associated with payment services and protect consumers and the financial system.

Key regulatory obligations for AFSL holders in the context of payment services include:

- General AFSL Obligations:

PSPs must comply with the standard obligations of AFSL holders, ensuring they provide financial services efficiently, honestly, and fairly. - Financial Requirements:

aintaining adequate financial resources is a key part of the financial requirement obligations as an AFS licensee and is crucial to ensure solvency and meet operational needs. This includes holding surplus liquid funds, with specific amounts potentially varying based on the payment function. - Compensation Arrangements:

AFSL holders should establish and maintain compensation arrangements for retail clients to cover potential losses resulting from breaches of obligations. - Dispute Resolution:

Implementing a robust dispute resolution system, which includes Australian Financial Complaints Authority (AFCA) membership, is essential for effectively handling complaints from retail clients. - Compliance and Reporting:

Licensees must provide information and assistance to ASIC and promptly report any significant breaches or reportable situations, which may lead to AFSL audits and investigations.

These obligations collectively aim to create a robust and trustworthy payments ecosystem and ensure that PSPs operate with integrity and accountability. Understanding and preparing for these regulatory obligations is paramount for entities seeking to operate within Australia’s modernised payment landscape.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Crypto, Stablecoins, and the Modernised Payments Landscape

Payment Stablecoins under the SVF Framework

Payment stablecoins are proposed to be regulated as a subset of SVFs within the modernised payments landscape. This approach is due to their functional similarities to traditional SVFs and bank deposit accounts, as they can be used for payments and store value. However, payment stablecoins differ from traditional SVFs as they typically operate without direct issuer involvement in transactions, functioning as bearer instruments for peer-to-peer transfers.

The government proposes a three-pronged definition for payment stablecoins:

- Digital Representation: They are a digital representation of monetary value intended to maintain a stable value relative to a fiat currency.

- Issuer: They are issued by a payment stablecoin issuer.

- Redemption: They can be redeemed at face value for Australian dollars or another fiat currency actively marketed in Australia through a claim on the issuer.

This definition explicitly targets stablecoins fully backed by cash or cash-equivalent reserves to ensure value stability, excluding those collateralised by more volatile assets like other crypto assets. The rationale for regulating payment stablecoins under the SVF category is rooted in the similar risks they pose to traditional SVFs, including financial, operational, and misconduct risks. Additionally, this regulatory alignment with SVFs is consistent with international regulatory approaches and recommendations from domestic reviews of the Australian payments system.

Licensing and Compliance for Crypto Payment Providers

For crypto payment providers, particularly those dealing with payment stablecoins, determining if your crypto business needs an Australian Financial Services (AFS) licence is crucial under the modernised payments landscape. The Australian government’s reforms aim to integrate crypto-based payment arrangements, such as payment stablecoins, into the regulated financial system. The AFSL framework is the cornerstone of this new regulatory regime, ensuring consistent and appropriate regulation of PSPs, including those in the crypto space.

Under the new framework, most stablecoin issuers in Australia will likely need to:

- Acquire an AFSL.

- Adhere to various regulatory obligations based on the functions of the products they offer.

These obligations are expected to align with those for standard SVFs, encompassing both prudential and consumer protection measures. For entities operating within Australia’s modernised payment landscape, understanding and preparing for these regulatory obligations is paramount to ensure compliance and maintain operational integrity.

Conclusion

Australia’s payment system is undergoing a significant transformation, introducing a new licensing framework for payment service providers (PSPs). This modernisation is driven by the need for a more efficient, secure, and innovative payments ecosystem that adapts to technological advancements and evolving customer expectations. The shift towards function-based licensing and introducing seven defined payment functions mark a significant change from the previous regulatory approach, requiring PSPs to reassess their operations and compliance strategies.

To navigate this evolving landscape, PSPs must prioritise understanding the new regulatory obligations and licensing requirements. For expert guidance and support in obtaining your AFSL and ensuring compliance with the modernised payments system, contact our AFSL compliance experts at AFSL House today. Our unparalleled expertise in Australian financial services licensing positions us to provide the tailored solutions you need to thrive in the payments industry.

Frequently Asked Questions

The primary goal of payment system modernisation is to update payment infrastructure to facilitate faster, more efficient, and secure transactions driven by technological advancements and evolving customer needs.

The main benefits of payment modernisation for PSPs include process efficiencies, greater ROI, improved security, interoperability, scalability, better customer experiences, enhanced risk management, and new revenue streams.

Under the new framework, a PSP is defined by the specific payment function it performs, which is categorised into seven defined payment functions.

Under the new framework, SVFs are payment accounts or facilities that store payment value. They are divided into traditional SVFs and payment stablecoin SVFs, each with specific regulatory approaches.

In the new regulatory landscape, ASIC will regulate standard SVFs and Payment Facilitation Services (PFSs) under the AFSL regime, focusing on conduct and compliance. At the same time, APRA will provide prudential oversight for Major SVFs and administer Common Access Requirements (CARs).

Not all stablecoins will be regulated as Payment Stablecoin SVFs; only stablecoins aiming to maintain a stable value relative to a fiat currency and fully backed by cash or cash-equivalent reserves are intended to be regulated as payment stablecoin SVFs. Other stablecoins may be subject to different financial product regulations.

PFSs under the new framework encompass services that facilitate fund transfers between payers and payees, including merchant acquirers, payment gateways, and certain money transfer services, capturing a broad range of payment-related activities.

The new framework will ensure a level playing field for PSPs by introducing CARs, which APRA oversees. It aims to facilitate direct access to Australian payment systems for non-ADI PSPs, promoting competition and innovation.

To prepare for the modernisation, PSPs should reassess their payment functions, understand the new licensing requirements, and prepare to apply for an AFSL. They should also consider the 18-month transition period.