Introduction

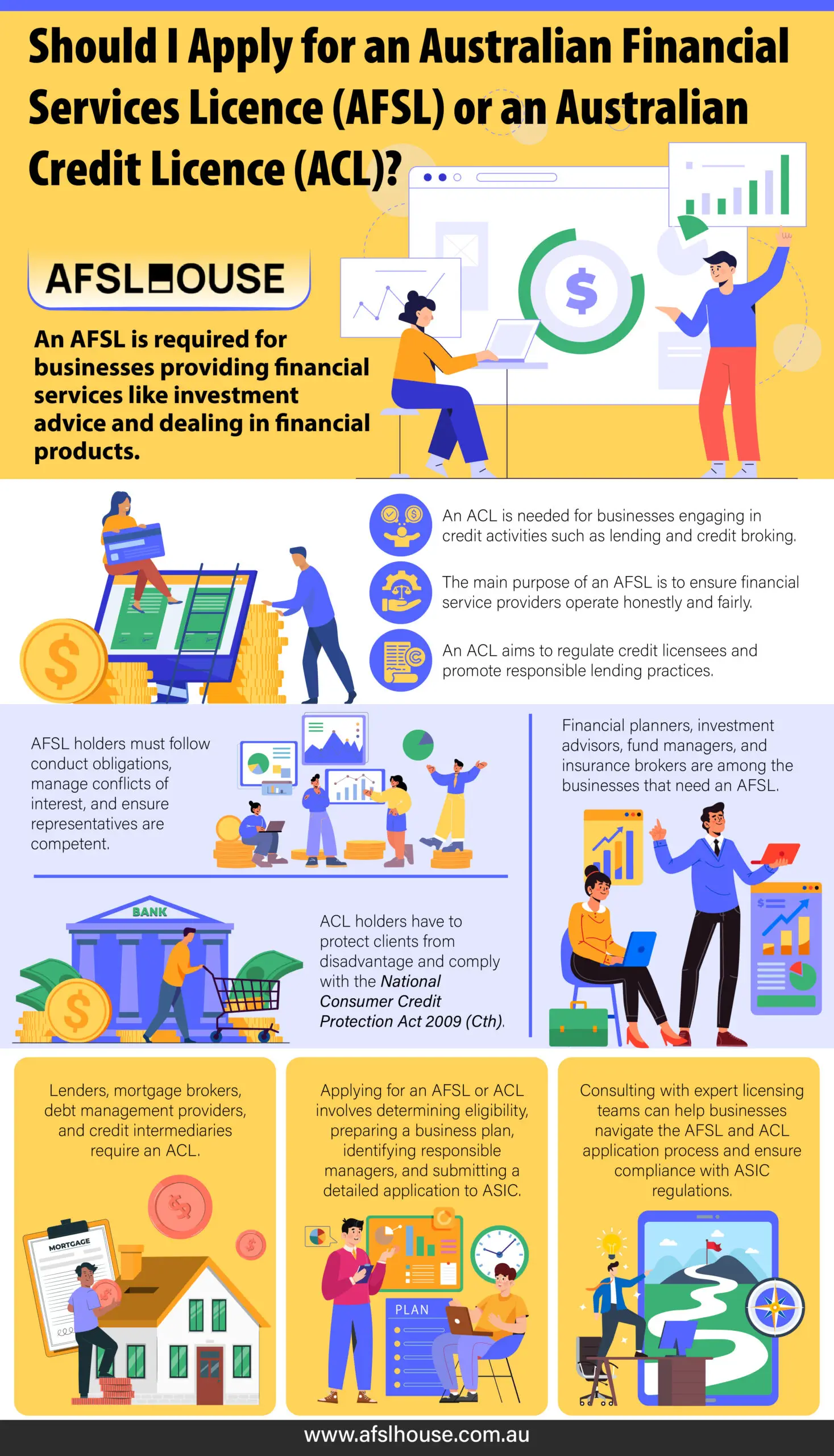

For businesses operating in Australia’s financial sector, selecting the right licence is crucial for compliance and service integrity. An Australian Financial Services Licence (AFSL) and an Australian Credit Licence (ACL) serve distinct purposes, each with specific regulatory requirements. Understanding these differences ensures your business meets legal obligations while effectively delivering financial services.

Choosing the appropriate licence mitigates regulatory risks and enhances credibility with clients. This guide explores the significance of both licences, helping businesses make informed decisions aligned with their operational needs and compliance responsibilities.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

What is an Australian Financial Services Licence (AFSL)?

Definition and Purpose

Under the Corporations Act 2001 (Cth), businesses providing financial services in Australia must obtain an AFSL unless they qualify for specific exemptions. An AFSL ensures that financial service providers operate within a regulated framework, upholding principles of honesty, integrity, and fairness in client dealings.

The primary objective of an AFSL is consumer protection, achieved through strict compliance with the Corporations Act 2001 (Cth) and related regulations. Licence holders must:

- Adhere to conduct and disclosure obligations

- Implement measures to identify and manage conflicts of interest

- Maintain accurate records and ensure proper reporting

- Verify that their representatives are competent to provide financial services

- Meet financial resource and capital adequacy requirements

Scope of AFSL

The scope of an AFSL extends beyond credit-related activities, covering a broad range of financial services. AFSL holders may engage in:

- Providing financial advice on investments, superannuation, and insurance products

- Dealing in financial products, including shares, derivatives, and managed investment schemes

- Managing investment funds and operating managed investment schemes

- Offering custodial or depository services for financial assets

- Executing transactions on behalf of clients in various financial markets

Additionally, AFSL holders with the appropriate authorisation may:

- Operate as market makers, providing liquidity for financial products

- Participate in crowdfunding initiatives

- Offer traditional trustee services

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

What is an Australian Credit Licence (ACL)?

Definition and Purpose

An ACL is a legal authorisation issued by the Australian Securities and Investments Commission (ASIC), allowing businesses, including sole traders, to engage in credit activities within Australia. Under the National Consumer Credit Protection Act 2009 (Cth), an ACL is mandatory for any entity providing credit or credit-related services.

The primary purpose of an ACL is to:

- Ensure compliance with consumer protection laws

- Regulate credit licensees to promote ethical and responsible lending practices

- Maintain industry standards by enforcing strict obligations on licensees

Scope of ACL

The scope of an ACL encompasses various credit-related activities, including:

- Providing Credit Assistance: Helping clients obtain loans or mortgages, including assisting with loan applications.

- Credit Broking: Acting as intermediaries between credit providers and consumers to arrange loans or mortgages.

- Offering Credit Contracts and Consumer Leases: Creating and managing credit agreements or leases with consumers.

- Loan Broking Services: Connecting clients with suitable lenders and facilitating the loan application.

These regulated activities promote fairness and transparency in the credit business. For example, a mortgage broker must hold an ACL to arrange home loans for clients legally, ensuring they adhere to responsible lending obligations.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Key Differences between AFSL and ACL

Scope of Services

The AFSL and the ACL serve distinct purposes within the financial industry. AFSL covers a broad spectrum of financial services, while ACL is tailored to credit-related activities.

AFSL Scope Includes:

- Providing financial product advice: This includes personal or general advice on investment products, superannuation, and insurance.

- Dealing with financial products: Activities such as buying and selling shares or derivatives on behalf of clients.

- Operating managed investment schemes: Managing funds or operating as a responsible entity for investment schemes.

- Making a market for financial products: Regularly quoting prices for buying or selling financial products.

- Providing custodial or depository services: Holding financial products or interests in financial products on behalf of clients.

ACL Scope Includes:

- Providing credit assistance: Helping clients apply for loans or mortgages.

- Brokering credit: Arranging loans or mortgages on behalf of clients.

- Offering credit contracts or consumer leases: Engaging in activities related to credit agreements.

- Acting as an intermediary: Facilitating transactions between credit providers and consumers.

While AFSL allows businesses to offer various financial services beyond credit, ACL focuses exclusively on credit activities. This distinction is crucial for businesses determining which licence aligns with their service offerings.

Compliance Obligations

Holders of AFSL and ACL are subject to different compliance obligations tailored to their specific service scopes.

- Conduct Obligations: AFSL holders must act honestly, fairly, and efficiently when providing financial services.

- Managing Conflicts of Interest: Implementing measures to handle potential conflicts between the business and its clients.

- Disclosure Requirements: Providing clients with a Financial Services Guide (FSG) that outlines the services offered and associated fees.

- Competence of Responsible Managers (RMs): Ensuring RMs possess the necessary qualifications and experience.

- Compliance with Financial Services Laws: Adhering to all relevant financial service laws and regulations.

ACL Compliance Obligations:

- Protecting Clients from Disadvantage: Ensuring conflicts of interest does not disadvantage clients.

- Conduct Obligations under the NCCP Act: Complying with the National Consumer Credit Protection Act 2009 (Cth), which includes responsible lending practices.

- Disclosure Requirements: Providing a credit guide to inform clients about the credit services offered and associated terms.

- Dispute Resolution Processes: Implementing appropriate mechanisms for resolving disputes with clients.

- Responsible Lending Practices: Assessing the creditworthiness of clients to prevent lending to unsuitable borrowers.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Who Needs an AFSL?

Types of Businesses

Financial planners, investment advisors, and fund managers are among the key businesses that require an AFS licence. Additionally, managed discretionary account (MDA) operators and advisers, money remitters, over-the-counter (OTC) derivatives market makers, and robo-advisers must hold an AFSL to offer their services legally. Insurance companies, brokers, banks, and other multidisciplinary financial institutions must also obtain an AFSL. Furthermore, businesses involved in managed investment schemes, such as fund managers, responsible entities, and custodians, must possess an AFSL.

Financial Services Offered

Holding an AFSL is necessary for providing a broad range of financial services, including but not limited to:

- Providing financial product advice: This includes personal and general advice on investment products, superannuation, and insurance.

- Dealing with financial products: Buying or selling shares, derivatives, or issuing interests in managed investment schemes.

- Making a market for financial products: Regularly quoting prices at which financial products can be bought or sold.

- Operating a registered managed investment scheme: Involves managing and overseeing investment schemes offered to retail clients.

- Providing custodial or depository services: Holding financial products or beneficial interests in trust for clients.

- Providing traditional trustee company services: Handling estate management functions and other trustee services.

- Providing a crowdfunding service: Facilitating fundraising for projects or businesses through crowdfunding platforms.

- Providing a superannuation trustee service: Managing superannuation funds for individuals.

- Providing claims handling and settling service: Managing and settling insurance or financial claims on behalf of clients.

- Operating the business and conduct of a corporate collective investment vehicle (CCIV): Managing and overseeing the operations of collective investment entities.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Who Needs an ACL?

Types of Businesses

Per Regulatory Guide 203 (RG 203), businesses that engage in various credit-related activities must hold an ACL. These include:

- Lenders: Institutions such as banks, non-bank lenders, and financial institutions that provide loans or mortgages require an ACL.

- Mortgage Brokers: Professionals who arrange home loans on behalf of clients need an ACL to broker credit agreements legally.

- Debt Management Service Providers: Organisations assisting clients in managing and consolidating debts must hold an ACL to offer these services.

- Credit Intermediaries: Companies that act as intermediaries between credit providers and consumers are required to obtain an ACL.

- Traditional Trustee Services: Businesses holding money or assets on behalf of clients in trust must have an ACL.

- Crypto Lenders: Fintech companies providing loans secured by cryptocurrency require an ACL to operate within the regulatory framework.

Credit Activities Offered

Holding an ACL is necessary for businesses that provide specific credit-related activities, including:

- Providing Credit Assistance: Helping clients apply for loans or mortgages involves offering credit assistance services, necessitating an ACL.

- Offering Credit Contracts and Consumer Leases: Engaging in creating, managing, and offering credit contracts or consumer leases requires an ACL.

- Credit Broking: Arranging loans or mortgages on behalf of clients by acting as an intermediary between credit providers and consumers, mandates holding an ACL.

- Loan Broking Services: Facilitating the loan application process and connecting clients with suitable lenders is an activity that requires an ACL.

- Issuing Credit Guarantees: Providing guarantees for credit contracts involves credit-related activities that necessitate an ACL.

- Managing Credit Portfolios: Overseeing and managing portfolios of credit products for clients requires compliance with ACL obligations.

Businesses must ensure they hold an ACL if they engage in any of these credit activities to comply with the National Consumer Credit Protection Act 2009 (Cth) and maintain adherence to consumer protection laws.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

How to Obtain an AFSL

Application Process

To apply for an AFSL, you must complete and lodge an online application through the ASIC Regulatory Portal. This integrated online transaction has replaced the previous system of submitting a Form FS01 and separate supporting documents.

The key steps in the application process are:

- Determine Eligibility and Authorisations: Assess which financial services your business will offer to determine the specific authorisations you need.

- Prepare Your Business Plan: Develop a comprehensive business plan outlining your financial services offerings, target market, and compliance strategy.

- Identify RMs: Appoint individuals with the necessary qualifications and experience to be your Responsible Managers.

- Complete the Online Application: Submit the detailed application transaction via the ASIC Regulatory Portal, including all required information about your business structure, processes, and RMs.

- Pay Application Fees: Ensure you pay the appropriate fees associated with the AFSL application, as calculated by the portal.

- Await Assessment: ASIC will review your application, which may involve requests for further information or clarification. The process can take several months, and many applicants choose to engage specialist AFSL lawyers to navigate the complexities.

Required Documentation and Criteria

When applying for an AFSL, you must provide comprehensive information directly within the online application and upload specific supporting documents.

- Business Description: Provide a thorough description of your business activities, including the financial services and products you will offer.

- Compliance and Risk Management Details: Outline how your business will adhere to its AFSL compliance and regulation obligations, including your compliance plan, risk management strategies, and arrangements for managing conflicts of interest.

- Responsible Manager Details: Provide evidence of your RMs’ qualifications, experience, and training to ensure they can competently oversee your financial services.

- People Proofs: Upload the required People Proofs for your RMs and other key persons. This includes criminal history checks, bankruptcy checks, and qualification certificates.

- Financial Resources Information: While you must attest to having adequate financial resources, detailed financial statements are now requested by ASIC at the later ‘requirements stage’ of the assessment, rather than with the initial application.

- Proof of Insurance: Evidence of Professional Indemnity Insurance is also typically requested at the ‘requirements stage’.

- Disclosure Documents: Be prepared to provide copies of your disclosure documents, such as a Financial Services Guide (FSG).

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

How to Obtain an ACL

Application Process

Applying for an ACL involves several key steps to ensure compliance with regulatory obligations.

- Determine Eligibility:

Assess whether your business activities fall under credit activities as defined by the National Consumer Credit Protection Act 2009 (Cth). This includes providing credit assistance, credit contracts, consumer leases, acting as a credit intermediary, and loan broking services. - Prepare Your Application:

Compile a comprehensive business description that outlines the credit activities you intend to engage in. This should include details about your business model, target market, and how you plan to comply with ACL obligations. - Identify RMs:

Appoint individuals who will be responsible for overseeing your credit activities. Ensure they meet the necessary qualifications and experience requirements. - Complete Background Checks:

Conduct background checks for all RMs, including police checks and assessments of their fitness and propriety. - Submit Your Application:

Complete and submit the ACL application form and all required supporting documentation to the ASIC. - Pay Application Fees:

Ensure that you pay the appropriate fees associated with the ACL application, as mandated by ASIC. - Await Assessment:

ASIC will review your application, which may involve providing additional information or clarifications. The assessment process can take several weeks to months.

Required Documentation and Criteria

When applying for an ACL, you must provide specific documentation and meet certain criteria to qualify.

- Business Description:

Provide a detailed business model overview outlining the credit services you intend to offer and your operational structure. - Financial Statements:

Submit current financial statements demonstrating your business’s financial stability and capacity to manage credit activities. - Compliance Plan:

Develop a comprehensive compliance plan outlining how your business will adhere to ACL obligations, including managing conflicts of interest and ensuring responsible lending practices. - RMs’ Qualifications:

Provide evidence of your RMs’ qualifications, experience, and training to ensure they can oversee your credit services. - Risk Management Strategies:

Outline your risk management and internal control systems designed to identify, assess, and mitigate potential risks in your credit activities. - Proof of Insurance:

Include necessary insurance certificates, such as professional indemnity insurance, to cover potential liabilities associated with providing credit services. - Disclosure Documents:

Prepare required disclosure documents, including a credit guide that informs clients about the credit services offered and associated terms.

Conclusion

Selecting the right licence—Australian Financial Services Licence (AFSL) or Australian Credit Licence (ACL)—is a critical decision for any business in Australia’s financial sector. An AFSL is required for businesses providing advice on financial products, dealing in securities, or managing investment schemes, while an ACL is essential for those engaged in credit-related activities like lending and broking. Understanding the distinct scope and compliance obligations of each is the first step toward building a sustainable and lawful operation.

To ensure your business secures the appropriate licence and adheres to ASIC regulations, contact AFSL House’s expert team to apply for an AFSL. With proven expertise in navigating the complexities of both AFSL and ACL applications, we streamline the process and help you confidently meet all compliance requirements.

Frequently Asked Questions

An Australian Financial Services Licence (AFSL) covers various financial services, including financial advice, dealing in financial products, and operating managed investment schemes. In contrast, an Australian Credit Licence (ACL) is specifically required for engaging in credit-related activities such as lending and credit broking.

Yes, a business can hold both an AFSL and an ACL. However, it must comply with the distinct obligations of each licence, ensuring that all regulatory requirements for both financial services and credit activities are met.

AFSL holders must adhere to various compliance obligations, including conducting financial services honestly and fairly, managing conflicts of interest, maintaining proper disclosure through a Financial Services Guide (FSG), ensuring the competence of responsible managers (RMs), and complying with all relevant financial services laws.

ACL holders must protect clients from disadvantage by managing conflicts of interest, complying with responsible lending practices under the National Consumer Credit Protection Act 2009 (National Credit Act), providing clear credit guides, implementing effective dispute resolution processes, and maintaining adequate financial resources. Additionally, they must ensure their representatives are properly trained and competent.

The time frame to obtain an AFSL or ACL can vary, but generally takes several weeks to months. The process involves determining eligibility, preparing a comprehensive application with necessary documentation, appointing RMs, completing background checks, and awaiting assessment by the Australian Securities and Investments Commission (ASIC).

Operating without the required licence can lead to severe penalties, including significant fines, legal repercussions, and potential suspension or cancellation of business operations. Non-compliance can also damage the business’s reputation and lead to loss of client trust.

No, an AFSL holder cannot provide credit services without holding an ACL. While an AFSL allows the provision of several financial services, credit-related activities specifically require an ACL to ensure compliance with credit protection laws.

Yes, certain exemptions exist for both licences, with the most common pathway being to operate as a representative of an existing licensee. Businesses can act as an Authorised Representative under an AFSL or a Credit Representative under an ACL, which exempts them from needing to hold their own licence.

To maintain ongoing compliance, businesses should implement robust compliance programs, which can include a regular AFSL compliance health check, and provide continuous training for RMs and staff. Additionally, seeking expert legal advice can help navigate complex regulatory landscapes and ensure adherence to all obligations.