Introduction

Securing an Australian Financial Services Licence (AFSL) is a fundamental step for entities seeking to provide financial services in Australia. Before the application process was streamlined on 16 June 2025, it was a standard procedure for the Australian Securities and Investments Commission (ASIC) to request applicants to furnish ‘additional proof documents’. This request was a key part of ASIC’s comprehensive assessment, ensuring applicants could demonstrate their organisational competence and capacity to meet the obligations of an AFS licensee under the Corporations Act 2001 (Cth).

This guide clarifies why ASIC requested these additional proofs under the former application system. It provides historical context and practical guidance on the purpose of those requests and what applicants needed to do when asked for more proof documents, explaining a now-superseded but important part of the AFSL application journey.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Important: June 2025 AFSL Application Changes

This article has been updated to clarify that the formal system of requesting numbered ‘additional proofs’ was superseded by ASIC’s new AFSL application process on 16 June 2025. The information is retained to provide valuable historical context on the depth of ASIC’s former assessment process. While this specific system is no longer in effect, ASIC may still request further information from applicants via the new ASIC Regulatory Portal.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Understanding When ASIC Requests Additional Proofs

Complexity of Services and Products

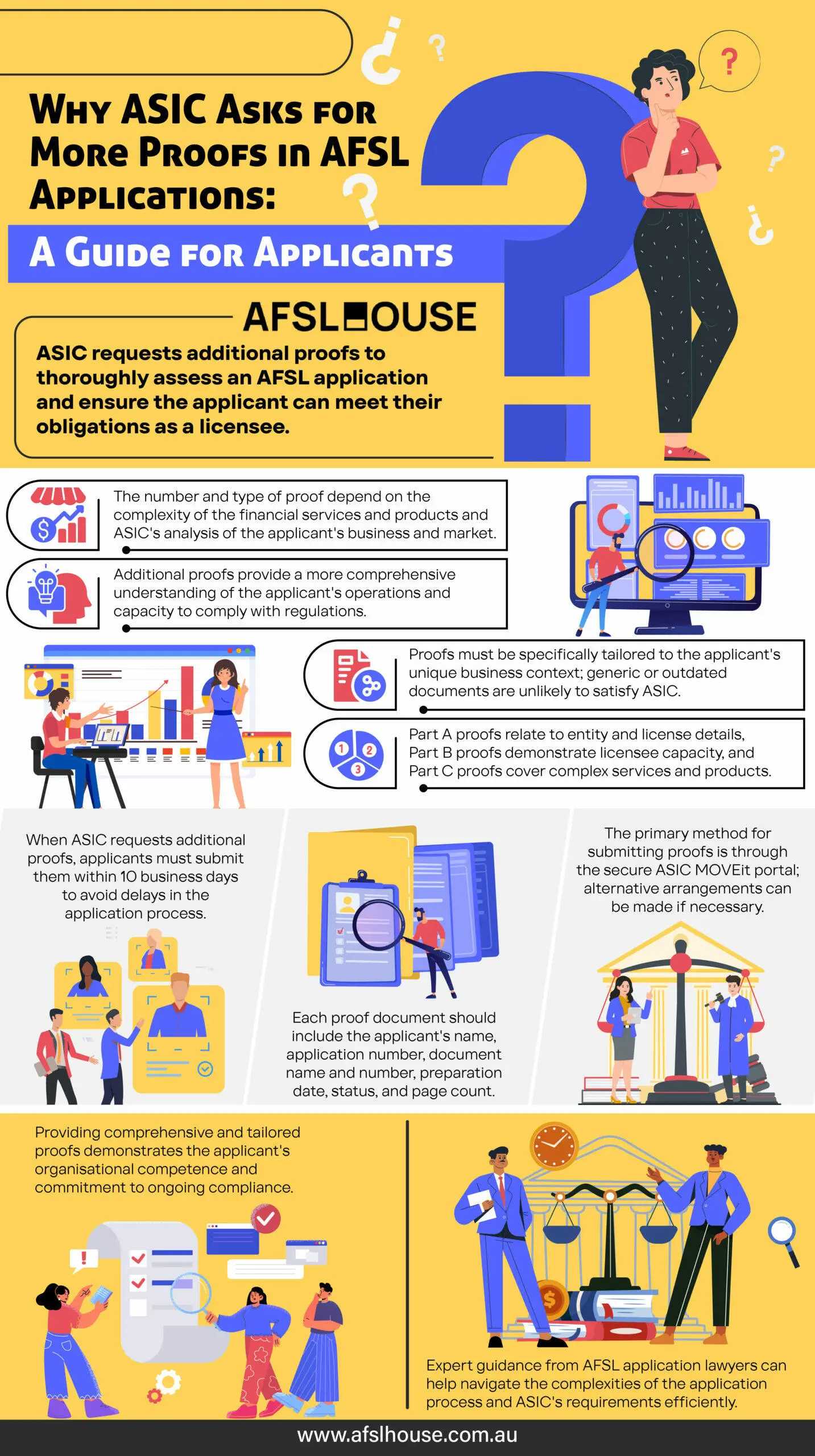

Under the former AFSL application system, ASIC would request additional proofs to complete their assessment. The number and type of additional proofs that were requested depended on:

- The complexity of the financial services and products the applicant had applied for; and

- ASIC’s analysis of the applicant’s business and the market in which they intended to operate.

Analysis of Business and Market

In addition to the complexity of the services, ASIC’s analysis of the business and its proposed market played a significant role in determining whether additional proofs were necessary. This analysis helped ASIC to:

- Understand the nuances of the applicant’s business model; and

- Assess its potential impact on the financial services landscape.

Based on this evaluation, ASIC decided if further documentation was required to ensure the applicant could meet their obligations as an AFS licensee.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

The Purpose of Additional Proofs: What ASIC Seeks to Verify

Detailed Information Requirements

ASIC requested additional proofs to delve deeper into aspects of an AFSL application. These additional proofs served to:

- Provide a more comprehensive understanding of the business’s operations; and

- Demonstrate the applicant’s capacity to meet their obligations as an AFS licensee.

While the initial core proofs were essential, they did not always offer the granular detail necessary for a fully informed assessment. Therefore, additional proof documents became necessary to supply this in-depth information, ensuring ASIC had a complete picture of the business and its preparedness for compliance.

The Need for Tailored Proofs

It was crucial that the additional proofs provided were specifically tailored to the business and its unique context. Generic or outdated proof documents were unlikely to satisfy ASIC’s requirements. For instance, if a business operated as part of a larger corporate group, its proofs had to clearly articulate how that specific entity would meet its AFS licensee obligations, rather than providing standardised group-wide proofs. Providing documents that were not directly relevant or current could lead to:

- Delays in the application process; and

- Potential rejection of the proofs altogether by ASIC.

Ensuring that additional proofs were relevant and up-to-date was a key factor in facilitating a smoother assessment.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Types of Additional Proofs ASIC May Request

Under the application system in place before 16 June 2025, ASIC could request a range of specific, numbered ‘additional proofs’ to gain a deeper understanding of an applicant’s business. This formal system of ‘core’ and ‘additional’ proofs is now obsolete, as this detailed information is largely captured within the new online application itself.

The following tables are retained for historical context, as they illustrate the granular level of detail ASIC has previously sought to assess an applicant’s capacity and competence.

Part A Proofs: Entity and Licence Details

Part A additional proofs were related to the information provided in Part A of the former application form. These proofs were focused on gathering more details about an applicant’s entity, the nature of their business, and the specific financial services and products they intended to offer.

The types of Part A proofs that ASIC might have requested included:

| Proof Number | Proof Name | Summary |

| A1 | Entity Details | Provided details about the legal structure of the business, such as names of partners, trustees, or a description of the entity’s nature for less common entity types. |

| A4 | Miscellaneous Financial Facility Statement | Required a detailed description of unique financial products and a legal opinion supporting their classification. |

| A4 | Membership of a Licensed Market | Required evidence of membership in a licensed market or a licensed clearing and settlement facility for businesses involved in market participation. |

Part B Proofs: Demonstrating Licensee Capacity

Part B additional proofs were designed to assess an applicant’s capacity to meet the obligations of an AFS licensee. These proofs delved into the organisational structure, compliance arrangements, and resources to ensure the applicant could competently operate under an AFSL.

Examples of Part B proofs included:

| Proof Number | Proof Name | Summary |

| B2 | Development Program for Responsible Managers | Demonstrated how responsible managers maintained competence through training and development programs. |

| B2 | Industry Standards Compliance | Provided evidence of an independent third-party assessment of compliance with relevant industry standards. |

| B3 | Compliance Arrangements | Outlined the compliance framework, including reporting lines, breach handling, and procedures for managing client funds. |

| B3 | Arrangements for Managing Conflicts of Interests | Described procedures for identifying, controlling, and disclosing conflicts of interest. |

| B3 | Outsourcing Statement | Detailed processes for selecting and monitoring external service providers to ensure they met AFS obligations. |

| B4 | Program for Monitoring, Supervision and Training of Representatives | Explained the supervisory framework for employees and authorised representatives. |

| B5 | Human Resources Capacity Statement | Described processes for ensuring adequate human resources, including recruitment and succession planning. |

| B5 | Information Technology Capacity Statement | Detailed IT resources, including strategic plans and disaster recovery plans. |

| B6 | Dispute Resolution System Statement | Described internal dispute resolution procedures and provided proof of AFCA membership. |

| B7 | Risk Management System Statement | Outlined the risk management strategy, including risk reviews and mitigation tables. |

| B8 | Compensation Capacity Statement | Provided evidence of professional indemnity insurance, including a certificate of currency and policy details. |

| B9 | Research Statement | Detailed the research processes for providing financial product advice. |

Part C Proofs: Complex Services and Products

Part C additional proofs were specifically related to complex financial services and products, which required more detailed substantiation. These proofs were triggered by selections made in the former AFSL application form.

Examples of Part C proofs included:

| Proof Number | Proof Name | Summary |

| C1 | Custodial/Depository Service Statement | Detailed the nature of custodial services, including client transaction processes and security measures. |

| C1 | IDPS Statement | Described how an investor directed portfolio service (IDPS) would define, hold, and protect IDPS property. |

| C2 | Scheme Operating Capacity Statement | Detailed the operation of registered schemes, including compliance structures and systems. |

| C3 | Market Maker Statement | Detailed market-making activities, risk disclosure, and internal controls. |

| C4 | Derivatives Statement | Explained activities with derivatives, including product nature, target clients, and risk management. |

| C5 | Foreign Exchange Operating Statement | Described operations with foreign exchange (FX) products and internal controls. |

| C6 | Horse Racing Syndicate Statement | Detailed compliance with specific ASIC regulatory guides for horse racing schemes. |

| C7 | Life Insurance Capacity Statement | Described processes for preventing ‘churning’ or ‘twisting’ in life insurance. |

| C8 | Underwriting Agency Capacity Statement | Provided details about underwriting operations, including insurer agreements and premium handling. |

| C9 | MDA Operator Capacity Statement | Explained how Managed Discretionary Accounts (MDAs) were managed and client assets handled. |

| C10 | Margin Lending Facilities Provider Statement | Detailed processes for providing margin lending, including suitability assessments and margin call procedures. |

| C11 | Crowdfunding Service Statement | Described how a crowdfunding platform would adhere to specific CSF regulations. |

| C12 | Insurance Claims Handling and Settling Service Statement | Detailed processes for fair and efficient insurance claims handling. |

| C13 | CCIV Operating Capacity Statement | Described the intended operations of a Corporate Collective Investment Vehicle (CCIV). |

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Responding Effectively to ASIC’s Request: What You Need To Do

Adhering to the 10 Business Days Deadline

When ASIC requested additional proof documents under the previous system, it was critical to respond promptly. Applicants were required to ensure that ASIC received the requested proofs within 10 business days of the date of the request. This timeframe was stipulated in the now-superseded ASIC Regulatory Guide 3, and adhering to it was essential for keeping the application process moving. Failure to submit the proofs within this timeframe could result in significant delays, as the ASIC analyst would pause their review until the information was provided.

Information to Include with Each Proof

To ensure efficient processing, each additional proof document had to be submitted with specific identifying information. This labelling convention helped ASIC correctly identify and process the submission. The required details included:

- Your name: The name of the AFSL applicant.

- Application number: The unique application number assigned by ASIC.

- Document name and relevant number: A clear label with the proof number (e.g., ‘B2 proof: Development Program for Responsible Managers’).

- Date the proof was prepared: The date the document was finalised.

- Status (if applicable): The document’s status, such as ‘Draft’ or ‘Commercial-in-Confidence’.

- Number of pages: The total page count of the document.

Submitting Proofs via the ASIC MOVEit Portal

The primary method for submitting additional proofs to ASIC was through the ASIC MOVEit portal. After an applicant submitted their online application, ASIC would send instructions via email on how to access and use this secure portal to upload documents. This system is no longer used for new AFSL applications; all correspondence and document uploads are now managed through the integrated ASIC Regulatory Portal.

Conclusion

Navigating the former AFSL application process was intricate, and understanding why ASIC requested ‘additional proof documents’ was crucial for applicants. Responding effectively to these requests was essential to maintain the momentum of an application. By providing comprehensive and tailored additional proofs, applicants demonstrated their organisational competence and commitment to meeting the ongoing compliance obligations of an AFS licensee, which facilitated a smoother review by ASIC.

While this system of ‘additional proofs’ is now historical, the underlying principle of responding diligently and promptly to any ASIC request for further information remains vital. For expert guidance in preparing a robust application under the current system, book a free consultation with AFSL House’s AFSL application lawyers today. Our team’s expertise can help you navigate the complexities of the modern process successfully and efficiently.

Frequently Asked Questions

‘Additional proofs’ were specific, numbered documents that ASIC could request from applicants under the application system in place before 16 June 2025. These proofs were requested in addition to the ‘core proofs’ submitted with the initial application to allow ASIC to further assess an application.

ASIC requested additional proofs during the assessment stage of the AFSL application process. If, after reviewing the initial application, ASIC determined that further information was needed, they would request specific additional proofs from the applicant.

If an applicant failed to provide the requested additional proofs, it could lead to significant delays in the application process. Failure to submit the proofs within the stipulated 10-business-day timeframe could also result in an unfavourable assessment, potentially triggering future AFSL audits or investigations by ASIC.

Yes, under the former system, ASIC had the authority to request proofs that were not initially listed in the application form. This typically occurred if ASIC determined that specific documents were necessary for a comprehensive assessment, particularly if the authorisations selected in the application were not correctly identified.

Additional proofs had to be specifically tailored to the applicant’s business and their AFS licensee obligations. Generic or outdated proof documents were not acceptable to ASIC and could delay the assessment.

The required method for submitting additional proofs to ASIC was via the ASIC MOVEit portal. This system is now obsolete for AFSL applications, as all documents and correspondence are managed through the new ASIC Regulatory Portal.

Yes, even when varying an existing AFSL, ASIC could request additional proofs under the old system. The requested proofs had to cover all financial services and products that would be provided under the newly varied licence, not just the proposed changes.

The additional proofs needed to contain information that specifically addressed the detailed requirements outlined in the now-superseded ASIC Regulatory Guide 3. These proofs had to be tailored to the specific business and demonstrate how it would meet its AFS licensee obligations.

If an applicant encountered issues accessing the ASIC MOVEit portal, there was an option to post the proof documents to ASIC. However, the MOVEit portal was the preferred and more efficient method for lodgement at the time.