Introduction: Understanding the AFSL Application Timeline

For financial services businesses in Australia, obtaining an Australian Financial Services Licence (AFSL) is a crucial step to legally provide financial services. The AFSL application process, administered by the Australian Securities and Investments Commission (ASIC), is designed to ensure that only competent and compliant entities are authorised as an Australian financial services (AFS) AFS licensee. Understanding the AFSL application timeline is therefore essential for financial services businesses seeking to commence operations and meet regulatory requirements.

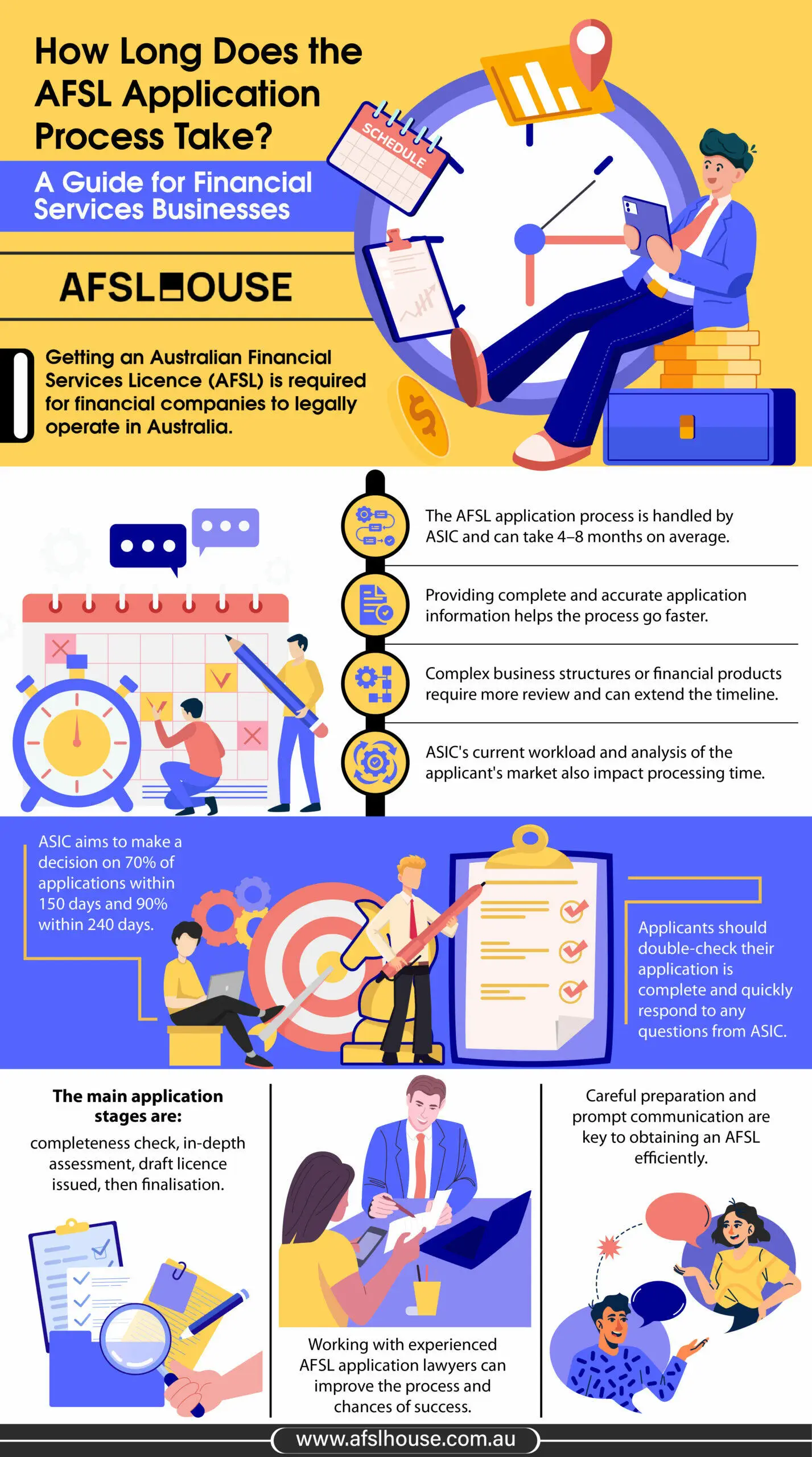

However, the AFSL application process timeframe can vary. The duration is influenced by factors such as the complexity of the financial services business, the quality and completeness of the afsl application, and ASIC’s assessment load. This guide aims to provide financial services businesses with a clear understanding of the typical AFSL application process timeline and the elements that can affect how long it takes to get an afsl licence.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Important: June 2025 AFS Licence Application Changes

This article has been updated to reflect the new AFSL application process introduced by ASIC, effective from 16 June 2025. This new system replaces the former process involving Form FS01 and multiple ‘core proof’ documents with a single, online application via the ASIC Regulatory Portal. The timelines and factors discussed below are based on this current, integrated process.

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Factors Influencing the AFSL Application Timeframe

Quality and Completeness of Application Information

The duration of the AFSL application process is significantly influenced by the quality and completeness of the information provided to ASIC. Applications that are well-prepared and contain accurate, comprehensive details are generally processed more efficiently. Conversely, applications lacking in clarity or essential information can lead to delays as ASIC may need to seek further clarification or request additional documentation.

To ensure a smoother and potentially faster assessment of your licence application, it is crucial to focus on the following aspects:

- Describing your proposed business accurately: Clearly articulate the nature of your financial services business, ensuring that it aligns with the authorisations you are seeking in your AFSL application.

- Selecting appropriate authorisations: Choose the correct financial service and financial product authorisations that accurately reflect the services you intend to provide under the AFSL.

- Providing a complete application and supporting documents: Ensure all required People Proofs are thoroughly prepared and uploaded, and that the online application is fully completed with the detailed information that replaces former core proofs (such as the A5 Business Description). Incomplete applications will result in rejection for lodgement.

- Prompt responses to ASIC queries: Respond to any queries or requests for further information from ASIC in a timely and comprehensive manner to keep the application process moving forward. Delays in responding to ASIC will extend the overall assessment timeframe.

Complexity of Business and Proposed Financial Services

The complexity of your financial services business model and the types of financial services you intend to provide are significant factors affecting the AFSL application timeframe. ASIC’s assessment process is tailored to the specifics of each applicant, with the level of scrutiny varying depending on the nature of the proposed business.

Businesses with intricate structures or those intending to offer complex financial services or products may undergo a more detailed and potentially lengthier assessment. This is because ASIC needs to conduct a more in-depth analysis to fully understand the business operations, risk management systems, and compliance frameworks.

Factors that contribute to the complexity of an application and may extend the processing time include:

- Intricate business structures: Organisational structures involving multiple entities or complex operational arrangements may require more time for ASIC to assess.

- Complex financial products: Applications involving sophisticated financial products or services, such as derivatives or managed investment schemes, often necessitate a more rigorous review due to their inherent complexity and regulatory requirements.

- Novel business models: Businesses with unique or innovative financial service offerings that are not easily categorised may require additional assessment time as ASIC evaluates their novelty and potential risks.

ASIC’s Assessment Load and Business Market Analysis

ASIC’s own workload and the extent of their analysis into your financial services business and the market you plan to operate within also play a role in determining the application timeframe. ASIC’s assessment approach is designed to be both efficient and effective, with the intensity of the assessment scaled according to their analysis of the applicant.

The level of analysis ASIC undertakes can vary based on several factors, including:

- ASIC’s workload: The overall volume of AFSL applications ASIC is currently processing can impact processing times. Periods of high application volume may lead to longer assessment timeframes.

- Market analysis: ASIC’s analysis of the specific market in which your business intends to operate and your proposed business model’s place within that market can influence the depth of their assessment.

- Risk assessment: ASIC’s determination of the potential risks associated with your proposed financial services business and its operations will affect the level of scrutiny applied during the assessment process. Higher risk profiles may necessitate more extensive review and analysis.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

ASIC’s Processing Times for AFSL Applications

ASIC provides target processing times for AFSL applications to guide applicants on expected timeframes. These targets are outlined in ASIC’s service charter and reflect the agency’s commitment to processing applications efficiently. However, it is important to understand that these are targets, and the actual processing time for individual applications can vary.

In practice, it may take ASIC between four and eight months to decide whether to grant an AFSL.

According to ASIC’s service charter results for 2023-24, ASIC aims to make decisions on the majority of AFSL applications within specific timeframes:

- 70% of applications within 150 days of receiving a complete application

- 90% of application decisions within 240 days of receiving a complete application

Speak with an ACL & AFSL Lawyer Today

Request a Consultation to Get Started.

Minimising Delays in Your AFSL Application

Ensuring Accuracy and Completeness of Information

Submitting an AFSL application that is both accurate and complete from the outset is crucial for avoiding unnecessary delays. Applications that are deficient in information or contain errors are likely to face significant delays. To streamline the application process and prevent holdups, applicants should prioritise the accuracy and completeness of all submitted information.

To ensure your application is processed as efficiently as possible, consider the following points:

- Describe your business accurately: Provide a precise and thorough description of your proposed financial services business within the online application. Clearly articulate the services you intend to provide and the financial products you plan to deal with.

- Select appropriate authorisations: Carefully choose all necessary authorisations that accurately reflect your business activities. Ensure that the authorisations you select are comprehensive and directly relevant to the financial services you intend to offer under the AFSL.

- Provide all required information and documents: Ensure every section of the online application is filled out accurately, providing the detailed information that supersedes former “core proofs”. All required supporting documents, namely the People Proofs, must be prepared meticulously and tailored to your business.

By taking these steps, you can significantly reduce the likelihood of ASIC needing to request further information or clarification, thereby minimising potential delays in the application process.

Prompt and Thorough Responses to ASIC Queries

Responding swiftly and comprehensively to any queries or requests for information from ASIC is essential to keep your AFSL application progressing smoothly. Delays in responding or providing incomplete answers can significantly extend the overall processing time. Therefore, efficient communication and thoroughness in your responses are key to minimising delays.

To ensure timely processing of your application, it is important to:

- Respond promptly: Address any questions or requests for further details from ASIC as quickly as possible. Aim to provide responses well within any specified timeframes to demonstrate your commitment to the process.

- Provide thorough answers: When responding to ASIC’s queries, ensure your answers are comprehensive and directly address all points raised. Incomplete or vague responses may lead to further rounds of questions and prolong the assessment.

- Supply requested documents efficiently: If ASIC requests additional documents, ensure these are prepared and submitted promptly through the ASIC Regulatory Portal (formerly it was the ASIC MOVEit portal). Efficient and organised submission of requested documents helps ASIC to continue their assessment without unnecessary delays.

Get Your Free Initial Consultation

Consult with one of our experienced ACL & AFSL Lawyers today.

Typical Stages in the AFSL Application Process

Completeness Check and Initial Assessment

The first stage in the AFSL application process is the completeness check. After you submit your online application through the ASIC Regulatory Portal—which consolidates the former Form FS01 and most core proofs into a single transaction—ASIC conducts this initial review to ensure all necessary information and documents have been lodged correctly.

If the application is deemed complete, ASIC will assign it to a licensing analyst. This analyst undertakes an initial assessment to understand the scope and nature of your financial services business. This stage primarily focuses on:

- Confirming that all required documents are present

- Preparing for a more detailed review of the application

In-depth Assessment and Requisitions for Information

Following the initial assessment, ASIC proceeds to a more in-depth review of your AFSL application. During this stage, assigned analysts thoroughly examine the details of your application and supporting documents to evaluate if your business structure, responsible managers, and compliance measures meet the regulatory requirements for an AFSL.

It is not uncommon for ASIC to issue requisition letters during this phase. These letters are formal requests for further information, clarification, or additional documentation, and failure to respond adequately can escalate the review into a formal AFSL audit or investigation. Responding to these requests promptly and thoroughly is crucial to keep your application progressing smoothly and avoid unnecessary delays in the process.

Draft Licence and Finalisation

If ASIC’s assessment is favourable, they will issue a draft AFSL to the applicant. This draft licence outlines the proposed authorisations, conditions, and financial services you are approved to provide. It is important to carefully review this draft licence to ensure its accuracy and alignment with your application and business intentions.

Upon your confirmation that the draft licence is satisfactory and that you wish to proceed, ASIC will work towards finalising the licence. This finalisation may involve:

- Addressing any outstanding requirements

- Providing final confirmations

Once these final steps are completed, ASIC will grant the final AFSL, officially authorising you to commence your financial services business.

Conclusion

Factors such as the complexity of your financial services business, the quality of your application, and your proposed AFSL compliance measures all play a role in determining the overall duration. However, your proactiveness in preparing a thorough application and responding promptly to ASIC queries can help minimise potential delays.

To navigate the complex AFSL application process successfully, contact our experienced AFSL application lawyers at AFSL House. Boasting a 100% success rate, we provide unparalleled expertise and tailored support to financial services businesses, assisting you in obtaining your AFSL and commencing your financial services business in Australia.

Frequently Asked Questions

Yes, you can expedite the process by ensuring your application is complete and accurate, including a comprehensive business description and all necessary documents. Respond to ASIC queries promptly.

ASIC aims to finalise most applications within 150 to 240 days of receiving a complete application. However, these are targets, and actual processing times may vary and in practice, it may take ASIC between four and eight months to decide whether to grant an AFSL.

Incomplete or inaccurate applications, complex business models, and delayed responses to ASIC queries can cause delays.

Yes, more complex authorisations, like those for novel financial products, may require longer processing times due to more rigorous reviews.

ASIC first checks for completeness, then assigns an analyst for in-depth assessment, and may issue requisition letters for more information.

No, the ASIC application fee is generally non-refundable, even if the application is withdrawn or refused.

Our AFSL lawyers provide expert guidance to prepare complete and accurate applications, minimising potential delays and requisitions from ASIC.

‘People Proofs’ are identity and good fame and character documents for your key personnel, including responsible managers, which must be uploaded with your application. Submitting incomplete or expired People Proofs will cause ASIC to reject your application for lodgement, leading to significant delays.

No, all AFSL applications must be submitted online through the ASIC Regulatory Portal. This mandatory electronic process is designed for greater efficiency and replaces all previous application systems.